Uptick Insight Series | 6 Ways Programmable Infrastructure Helps

Businesses Survive Platform Changes

Published on Oct 26, 2025

Today, businesses worldwide build their digital worlds on borrowed

infrastructure they fundamentally don’t control, facing algorithm

changes they can’t predict and relying on policies that shift without

warning or recourse.

This worked when platforms were just neutral marketplaces connecting

businesses with customers, but the relationship has turned completely

extractive as platforms increasingly capture value from the very

businesses that made them valuable in the first place.

Every business owner has a familiar sense of this anxiety, from the

retailer whose Facebook ad reach collapsed overnight when the

algorithm suddenly shifted, to the service provider whose marketplace

ranking completely vanished under new fee structures, to the event

organizer whose payment processing just flat out froze when platforms

changed terms.

These are symptoms of a structural flaw where businesses create value

on infrastructure they don’t own.

Traditionally, businesses have either resigned themselves or

diversified across multiple platforms, hoping at least one stays

reliable, but this model really just seems outdated at this point and

reveals the necessity for owned operational infrastructure rather than

renting from platforms.

In this article, we explore six ways programmable infrastructure gives

businesses genuine ownership over their operations. From event tickets

that automatically adapt to regulations, to art sales that generate

perpetual royalties, to loyalty programs that work across channels.

These practical applications put businesses back in control of their

operations, customer relationships, and revenue streams.

Let’s get into it.

COVID seems like nothing more than a hazy dream now, but as the dust

settled, it exposed how traditional ticketing systems completely

collapse under regulatory chaos, as concert halls that sold 2,000

tickets suddenly faced 500-person limits and spent weeks manually

contacting disappointed customers through refund processes that really

should have just taken minutes.

Sports venues struggled to verify vaccine requirements through chaotic

phone calls, creating entry bottlenecks, festival organizers watched

weather restrictions invalidate tickets without any way to adjust

capacity, and promoters worked nonstop to keep everything fair as

every regulatory shift required manual intervention that legacy

infrastructure simply couldn’t handle.

The challenges of manual ticketing systems made clear the need for

solutions that automate responses to real-world changes, and that

event organizers needed tools that could smoothly react to shifting

regulations without delays, errors, and customer frustrations.

Concert promoters need infrastructure that is able to react as fast as

the regulations themselves, where a 2,000-seat venue hit with a sudden

500-capacity limit could instantly process refunds instead of drowning

staff in spreadsheet chaos at midnight. Uptick’s smart contracts

embedded directly into digital tickets make this possible, executing

predefined rules the moment conditions trigger them and processing

thousands of programmable NFTs while organizers sleep instead of

manually calling disappointed ticket holders one by one.

As mentioned, sports venues faced their own nightmare, where vaccine

verification requirements turned entry gates into bottlenecks where

staff chaotically scrambled with clipboards and phone calls to check

credentials. Uptick’s decentralized identity framework solves this by

allowing ticket holders to prove compliance without exposing personal

health data, using selective disclosure and zero-knowledge proofs that

process verification instantly at entry points rather than creating

lines that snake around the block.

Secondary markets presented another crisis, as scalpers listed $80

tickets for $600 while organizers watched helplessly from the

sidelines, but Uptick’s programmable NFTs give organizers control by

embedding resale price limits and transfer rules directly into

tickets, recording every ownership change on-chain so transparency

replaces exploitation and fans can actually afford to attend shows.

Season ticket holders weren’t immune to these problems either, as

venues struggled to adjust capacity across multiple games spent hours

manually updating seat assignments and calling thousands of fans to

explain changes that should have happened instantly. Programmable NFTs

with embedded properties that adjust automatically when regulations

shift solve this, as Uptick’s Decentralized CRM is designed to track

season ticket holders and send automated notifications when capacity

changes, delivering seat reassignments or event updates directly to

wallets instead of forcing venue administrators to work through

outdated email lists at midnight.

When games get disrupted, and where integrated, smart contracts have

the ability to mint tokenized credits embedded as redeemable NFT

properties that holders apply toward future purchases, concessions, or

merchandise. Uptick’s Loyalty and Rights Management infrastructure can

maintain the full record of issued credits and redemption history,

creating a system where compensation accumulates in fans’ wallets

instead of disappearing into phone queues and forgotten refund

requests that take weeks to process.

As oracle integration expands, these responses become fully automated

through real-world data feeds, enabling ticket adjustments and credit

distributions to happen instantly when regulations change rather than

waiting for venue staff to implement updates manually. Press enter or

click to view image in full size

Digital artists sell work once and lose all connection to its future

success, watching buyers profit from resales worth tens of thousands

as the creators who made these transactions possible receive zero

compensation for the ongoing value their work generates.

The art world operates on a broken model where artists capture value

only at initial sale despite being the sole source of cultural

significance driving appreciation, creating systematic injustice that

repeats thousands of times daily as secondary market transactions

enrich everyone except the artists whose creativity made these markets

exist.

This pattern plays out predictably, as, let’s say a digital sculptor

spends months perfecting an installation that sells for $3,000, only

to discover it flipped for $25,000 two weeks later, then resold again

for $50,000 six months after that.

The gallery takes cuts, platforms take cuts, buyers profit handsomely,

and the creator receives nothing from the $47,000 in additional value

her work generated.

Multiply this across thousands of artists and millions of

transactions, and an entire creative class gets systematically

excluded from wealth their creativity creates. The problem compounds

as art moves between platforms, severing the artist’s connection with

each transfer. A piece mints on Ethereum, moves to Polygon for lower

fees, then lands in a private collector’s vault on Binance Smart

Chain, as each chain-hop breaks tracking and makes ongoing

compensation impossible.

Major marketplaces like OpenSea now support the ERC-721C creator token

standard for new collections, but this only enforces royalties for

works specifically minted using these standards, leaving millions of

existing artworks without protection as they circulate through

peer-to-peer sales and emerging marketplaces ignoring voluntary

metadata completely.

Artists need infrastructure that is able to follow their work wherever

it travels, embedding compensation rights directly into the art itself

so royalties flow automatically instead of disappearing the moment a

piece changes hands. Uptick’s programmable NFT metadata makes this

possible by allowing creators to encode royalty terms at the moment of

minting, so smart contracts execute distributions when resales occur

on compatible marketplaces.

The digital sculptor’s $3,000 initial sale happens normally, but when

subsequent buyers flip the piece for $25,000 and then $50,000, smart

contracts recognizing Uptick’s embedded terms trigger royalty payments

directly to the artist’s wallet according to predefined percentages.

The artist no longer watches from the sidelines as her work generates

$47,000 in additional value, she receives her share automatically with

each transaction.

The cross-chain problem that severed artist connections as work moved

from Ethereum to Polygon to Binance Smart Chain gets addressed through

Uptick’s cross-chain infrastructure, which maintains NFT metadata

intact across blockchain transfers. The programmable terms embedded at

minting travel with the artwork, preserving royalty logic regardless

of which ecosystem the piece lands in.

Uptick’s Loyalty and Rights Management system provides the complete

transaction history, showing every sale price, ownership transfer, and

provenance detail in immutable on-chain records. Collectors value this

verified authenticity, and the transparent record increases artwork

worth beyond what opaque marketplaces could offer.

Uptick infrastructure fundamentally reshapes how artists participate

in secondary markets by embedding economic terms directly into artwork

that travels across blockchain ecosystems. The vision’s success, does

however, depend on marketplaces recognizing and enforcing these

protocol-level standards rather than treating them as optional

metadata, but compatible platforms executing Uptick’s embedded royalty

logic create ongoing revenue streams that traditional art markets

systematically denied to creators.

Beyond regulatory challenges, businesses face another infrastructure

limitation that destroys their most valuable relationships.

Small businesses really struggle with fragmented customer

relationships where their most valuable customers engage across

multiple channels but need to perform a balancing act of separate

apps, cards, and reward systems that don’t recognize their total

contribution. The modern business world forces customers into isolated

experiences where their comprehensive relationship with a brand gets

divided across disconnected systems, as businesses lose opportunities

to recognize and reward their best customers in ways that would cement

long-term dedication.

Coffee shops watch this kind of fragmentation unfold constantly.

Their best customer visits the downtown location every morning, orders

beans online monthly, and follows their food truck to three different

neighborhoods, spending $2100 annually across these touchpoints.

The barista serving them downtown has zero visibility into their

online purchases. The food truck operator doesn’t recognize them from

the physical shop. Each interaction starts from zero despite this

customer representing the business’s most valuable relationship, as

fragmented loyalty systems force them to juggle separate punch cards

and reward programs that don’t communicate.

The administrative complexity compounds this waste, because updating

rewards requires coordinating across different platforms, and

launching new perks means multiple implementations, and understanding

customer behavior needs manual data compilation. Business owners end

up spending more time managing loyalty infrastructure than building

relationships as customers grow frustrated maintaining separate

identities for the same brand.

These kinds of fragmented touchpoints destroy business relationships

before they can mature, where a customer spending $2100 annually

across a coffee shop’s downtown location, online store, and food truck

gets treated as three separate strangers because loyalty systems don’t

recognize their comprehensive engagement. Uptick’s loyalty NFTs can be

designed to consolidate this scattered activity into a single digital

wallet, so those 50 downtown visits, monthly online orders, and food

truck breakfasts get tracked within unified programmable credentials.

Smart contracts could be coded to recognize spending milestones

automatically and trigger loyalty tier upgrades without requiring

staff to manually update systems across three different platforms.

Benefits like early access to seasonal blends or shipping fee waivers

get embedded directly into the NFT properties, executing when

conditions are met rather than waiting for someone to process rewards

during business hours.

The system’s programmable nature allows businesses to create dynamic

reward structures where loyalty credentials evolve based on customer

engagement, minting tiered loyalty NFTs when customers reach lifetime

spending milestones with each tier unlocking specific benefits. The

beauty lies in complete customizability, where businesses structure

smart contract logic according to their individual needs rather than

conforming to rigid templates that ignore how they actually operate in

the real world.

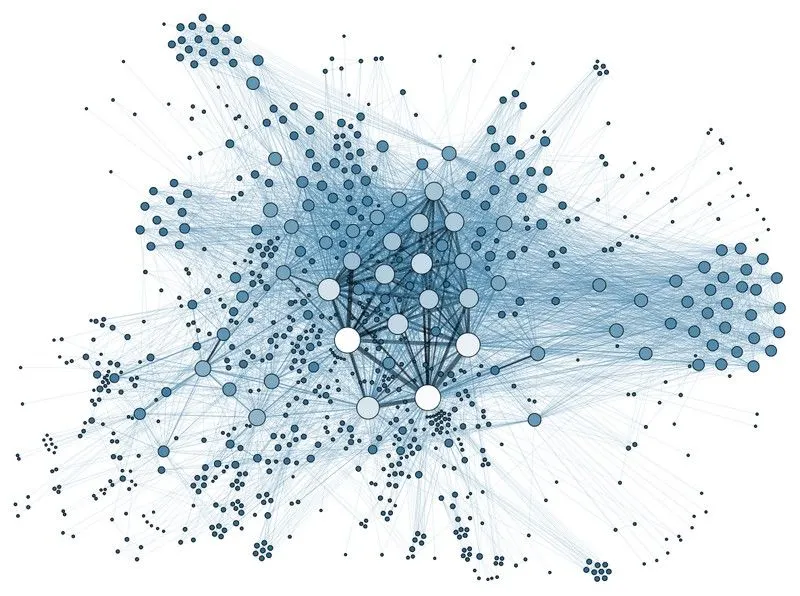

Partnership networks extend this value beyond single businesses, as

that customer’s loyalty NFT can provide benefits across participating

companies with all partners recognizing the shared credential through

Uptick’s cross-chain infrastructure. When participating businesses

offer exclusive benefits to loyalty holders, customers with qualifying

NFTs access these perks automatically, with Uptick’s identity system

providing verification without exposing personal information.

Yet again, Uptick’s Loyalty and Rights Management system maintains

complete history showing spending patterns, tier progressions, and

benefit redemptions, creating immutable on-chain records that

businesses use to understand customer behavior without compromising

privacy.

What we end up with is programmable credentials that consolidate

engagement into unified recognition that follows customers everywhere

they interact, creating relationships that deepen automatically with

every purchase across all participating touchpoints.

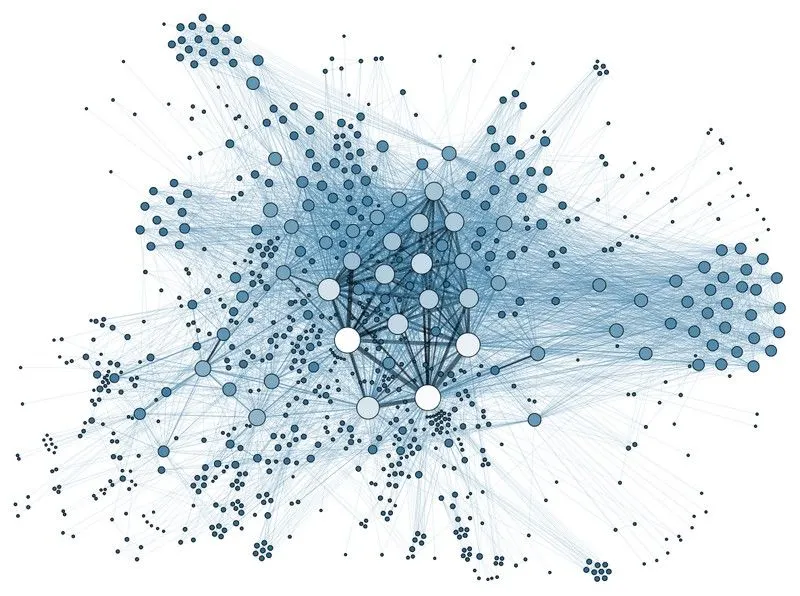

Administrative overhead frequently causes collaborative projects to

fail, where tracking individual contributions, managing evolving team

roles, and distributing revenue fairly actually becomes more complex

than the creative work itself. The dream of collaborative creation

gets buried under manual bookkeeping that consumes more energy than

the project intended to channel toward ambitious goals, turning

creative partnerships into administrative nightmares that ruin the

relationships they were meant to strengthen.

Research collectives building open-source tools face this collapse

immediately, when let’s say a climate data analysis project starts

with three founding members across different countries, each

contributing code and datasets, but six months later a Brazilian

contributor joins with critical machine learning algorithms. The team

now needs to renegotiate payment splits, update legal contracts, and

manually track who contributed what across multiple work streams,

turning what began as exciting collaborative work into a part-time

accounting job nobody really wanted.

Administrative complexity grows exponentially with success, and manual

systems that worked for three people completely break when the team

reaches seventeen contributors across six countries with different tax

requirements and varying commitment levels. Each new contributor means

updating agreements, each revenue event demands recalculating splits,

and tracking contributions requires maintaining spreadsheets that

capture work across repositories, datasets, and documentation.

Uptick’s token-based governance systems address this by allowing

research collectives to issue governance tokens proportional to

initial contributions, with subsequent work tracked through the

project’s chosen validation mechanisms. When that Brazilian

contributor joins with machine learning algorithms, the DAO votes to

grant them a percentage of governance tokens based on demonstrated

value, and smart contracts update payment allocations according to the

new token distribution automatically.

Eighteen months after launch, when the tool generates its first

licensing revenue, smart contracts distribute funds to all

contributors based on their token-weighted participation. The founding

member holding a larger percentage receives proportional amounts, and

newer contributors receive distributions according to their stake,

with payments executing across multiple jurisdictions through crypto

transactions that avoid traditional international wire fees and weeks

of processing delays.

Uptick’s cross-chain infrastructure will eventually enable the DAO to

operate across blockchain networks, letting contributors hold

governance tokens on different chains while participating in

proposals. When the collective votes to allocate funds from treasury

reserves, multi-sig wallet infrastructure requires approval from key

contributors before releasing funds, executing distribution once

consensus emerges through on-chain voting where Uptick’s identity

system provides verification without exposing personal information.

Token-weighted governance and smart contract payment logic replace the

spreadsheets, manual reconciliation, and constant renegotiation that

kill collaborative projects before they reach potential. Programmable

systems handle administrative complexity that would otherwise consume

more energy than the creative work itself, allowing seventeen

contributors across six countries with different tax requirements and

varying commitment levels to focus on building rather than

bookkeeping.

Data networks operate on extractive models where thousands of

volunteers contribute valuable information as institutions pay

substantial licensing fees to access aggregated data, creating systems

where contributors do the work but receive none of the economic value

they generate.

This unfair arrangement has gone on for decades as individuals provide

the raw materials that create valuable datasets as economic benefits

flow entirely to institutions and platforms that aggregate and sell

access to information they didn’t create.

Environmental monitoring networks demonstrate this injustice at scale.

For instance, when a volunteer in Mumbai operates an air quality

sensor on her balcony, checking calibration weekly and uploading

pollution readings every hour for three years as part of an 800-person

network spanning 50 cities. She invested $450 in equipment, pays

monthly internet fees, and dedicates hours to maintenance,

contributing 26,000 verified data points tracking climate patterns

across South Asia.

When a major university pays $180,000 to license the complete dataset

for research, all she receives is a thank-you email as institutions

monetize the precise information her years of consistent effort made

possible.

This pattern repeats across citizen science projects tracking wildlife

populations, medical research where patients contribute health data,

and community documentation initiatives, as thousands of contributors

perform actual collection work and institutions capture 100% of

licensing revenue.

Uptick’s programmable NFTs address this by allowing data networks to

issue digital credentials representing proportional ownership based on

contribution metrics tracked through the system. That 800-member

environmental monitoring network can weight NFTs according to

predefined criteria like data quality scores, uptime, and geographic

coverage, with contribution records stored via decentralized storage

so every sensor operator maintaining consistent readings receives

recognition tied directly to their work.

When that university purchases licensing rights, smart contracts

distribute payments to all contributors based on their NFT-weighted

participation recorded throughout the dataset’s history. Contributors

holding different percentages of dataset tokens receive proportional

amounts according to payment distribution logic embedded in the smart

contracts, with payments executing across multiple jurisdictions

through crypto transactions that avoid traditional international wire

transfer delays and fees.

Uptick’s cross-chain infrastructure enables the tokenized model to

operate across blockchain networks, so when the network votes to

expand coverage requiring equipment purchases, governance tokens

granted proportionally to NFT holders enable community

decision-making. Uptick’s DAO infrastructure supports decentralized

governance where proposals require approval based on predefined voting

thresholds before executing fund releases, with Uptick’s identity

system providing verification, all while preserving participant

privacy.

Programmable frameworks transform extractive models that reward only

institutions into systems where the thousands of volunteers performing

actual collection work participate directly in the economic value

their consistent effort generates. Contributors hold tokenized stakes

in the datasets they build, and ownership and revenue distribution

operate through infrastructure where their years of uploading

readings, checking calibration, and maintaining equipment finally

translate into the compensation those contributions always deserved.

Event promoters lose tremendous value selling static VIP packages that

can’t evolve with opportunity, missing chances to surprise fans with

spontaneous added value or reward loyalty through experiences that

grow more valuable over time.

The traditional event industry operates on a model where value gets

locked in at the moment of ticket purchase, preventing promoters from

capitalizing on their best ideas and most generous impulses as it

leaves fans with experiences that never exceed initial expectations.

Concert promoters sell VIP packages months in advance and feel trapped

by upfront promises as their best ideas come later during artist

collaboration and venue planning, but traditional ticketing

infrastructure locks value at sale time and prevents the kind of

evolving experiences that create superfans and drive word-of-mouth

marketing.

A promoter might secure a last-minute acoustic session with the

headliner, arrange exclusive merchandise from the artist’s personal

collection, or gain access to a private venue space, yet they have no

way to share these opportunities with their most loyal supporters.

The static nature of traditional event experiences means missed

opportunities for surprise and delight that define memorable

entertainment. When artists decide to do impromptu meet-and-greets,

when special guests make unexpected appearances, or when unique

performance elements get added to shows, VIP ticket holders can’t be

included since their packages were defined months earlier.

A lot of the time, these spontaneous moments become the most

talked-about aspects of events, but as it stands, the fans who

invested most in supporting the experience get excluded from the

magic.

Promoters watching last-minute opportunities slip through their

fingers because static ticketing locked experiences at purchase faced

a fundamental infrastructure problem. That acoustic session secured

two weeks before the show, the exclusive merchandise from the artist’s

personal collection, or the private venue space gained through venue

negotiation couldn’t reach the VIP ticket holders who deserved them

most because traditional systems defined packages months earlier and

offered no way to update them.

Uptick’s programmable NFT infrastructure is designed to address this

by allowing VIP passes to evolve throughout event experiences. Early

purchases unlock behind-the-scenes content during rehearsals,

attendance delivers high-quality recordings afterward, and social

sharing grants priority access to future tours as NFT properties

update based on event milestones. Once Uptick Oracle is fully

integrated, these updates can respond to holder actions and real-world

triggers automatically, creating truly dynamic experiences that adapt

without requiring promoters to manually coordinate complex customer

service operations.

Last-minute decisions to offer virtual meet-and-greets update NFT

metadata instantly, showing new perks in holders’ wallets rather than

forcing staff to send thousands of individual emails at 2 AM. The

passes become living, breathing records of fan relationships where

attending multiple shows unlocks exclusive merchandise and viral

content sharing grants backstage access.

Smart contracts structured through Uptick’s programmable NFT system

create loyalty rewards that build increasingly valuable experiences as

engagement deepens, so repeat attendees who drive ticket sales and

bring new supporters receive escalating recognition rather than

getting treated identically to first-time buyers.

Fan engagement stays high for months instead of dying after events

end, turning one-time buyers into superfans who eagerly await whatever

comes next as programmable infrastructure transforms static VIP

packages into evolving experiences that surprise and delight

throughout entire event lifecycles.

This enables promoters to capitalize on their best ideas and most

generous impulses rather than watching opportunities pass because

ticketing systems couldn’t adapt.

Platforms will change their rules, that much remains inevitable, but

businesses that recognize this reality and build on programmable

foundations position themselves to adapt rather than spending months

rebuilding from scratch after the next algorithm shift destroys what

took years to create.

When business logic embeds directly into assets through protocols like

Uptick’s cross-chain compatible frameworks, those assets carry their

own terms regardless of which platform hosts them or which network

they traverse, as artists’ royalty logic persists across marketplaces,

loyalty credentials accumulate value across channels, and

collaborative agreements execute automatically without platform

intermediaries dictating terms.

Companies building on programmable infrastructure are able to adapt to

regulatory shifts, evolving customer expectations, and platform policy

changes because their core infrastructure responds to conditions

rather than breaking under them, as event organizers adjust capacity

automatically when regulations shift, data contributors receive

compensation regardless of which institutions license datasets, and

fan relationships deepen over time instead of resetting with each

interaction.

The businesses that genuinely own their infrastructure will navigate

the next decade of platform volatility and capture value from every

transaction, but those that rent will simply watch opportunities

vanish each time terms of service updates arrive and profits flow to

intermediaries who contributed absolutely nothing to the value being

created.

Visit

uptick.network

to explore how programmable infrastructure can work for your specific

business needs.