Building a Sustainable Web3 Infrastructure and Ecosystem

Published on Feb 20, 2025

Web3 is no longer a fringe experiment.

Ownership, finance, and commerce are moving on-chain, breaking free

from centralized platforms, but without the proper infrastructure in

place, this shift risks losing momentum and failing to scale

effectively.

Web1 brought information online, creating a digital repository of

knowledge. Web2 expanded this by introducing commerce and social

interactions, but it came at a cost as centralized platforms took

control, dictating what people could publish, buy, and own.

Web3 reshapes how we interact online by enabling sovereign ownership,

decentralization, and frictionless transfers, fundamentally redefining

how value moves across the internet. Ideology alone cannot drive

adoption though, it’s the underlying infrastructure that brings this

vision to life and enables it to scale.

The Infrastructure Problem

Web3 has a scaling problem.

It’s not about decentralization, that part actually works.

The real challenge is making it fast, cheap, and usable without

breaking what makes it valuable. Early blockchains proved that

decentralized networks can function, but they also brought to the

surface numerous failures, such as slow transactions, unpredictable

fees, and siloed ecosystems that can’t talk to each other.

Meanwhile, Web2 platforms process thousands of transactions per second

with minimal friction. If Web3 can’t match that, it stays a niche

experiment rather than a legitimate alternative.

UX is the real struggle, and if users need multiple steps just to

complete a simple transaction, or if confirmations take 30 seconds,

they probably won’t stick around too long, and default back to Web2,

where everything just works. Web3 has the tech, but without effortless

onboarding, low-latency interactions, and a fluid experience, it most

likely won’t replace anything, it’ll just be another speculative

playground for insiders.

Scalability is improving, with rollups handling more transactions, and

gas fees coming down, but even as those problems are solved, the issue

of interoperability still looms. Web2 platforms exchange data freely,

but Web3 chains, for the most part, don’t. Ethereum, Solana, Cosmos,

and Polkadot all operate on different architectures, and moving assets

between them isn’t a simple endeavor. In fact, it can be an incredibly

frustrating experience, especially for newbies.

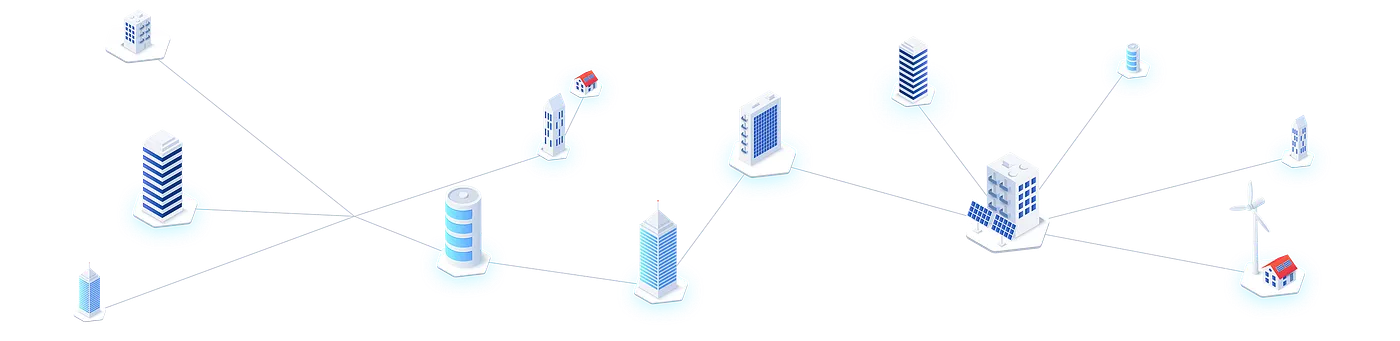

The end result is fragmented liquidity and bottlenecked innovation.

This is why we believe cross-chain infrastructure is so important, and

Uptick’s Cross-Chain Bridge (UCB) and Inter-Blockchain Communication

(IBC) are absolutely necessary for Web3’s survival. They allow

permissionless, direct asset and data transfers, cutting out the need

for centralized intermediaries.

This is about keeping Web3 from becoming a walled garden of

disconnected ecosystems. If Web3 wants to scale, it must solve these

problems in practice, not in theory.

The Shift Towards a Scalable Web3

Web3 is moving past its all-in-one approach.

Instead of forcing everything onto a single chain, networks are

breaking execution, consensus, and data availability into separate

layers. This modular shift is making Web3 faster, cheaper, and more

scalable.

As we just mentioned, cross-chain movement is also evolving. Uptick’s

UCB and IBC integrations enable trustless transfers of tokenized

assets across multiple networks, and these protocols cut out

centralized intermediaries, creating a much more open and efficient

Web3 economy.

Ownership and Interoperability Matter More Than Speed

Scaling Web3 infrastructure is one thing, but actually making it

usable is another.

Speed helps, but without true ownership and interoperability, Web3

risks becoming Web2 with extra steps. Think about Web2 for a moment.

Platforms own the data, assets, and user identities. You can create

content, buy digital goods, or build businesses, but you don’t really

own any of it. Platform rules change overnight, policies shift, and

accounts get shut down without warning.

Web3 is supposed to change that.

Ownership is on-chain, secured by cryptographic guarantees, and

transferable without a middleman. But if assets are locked inside

isolated ecosystems, they lose what makes them special in the first

place, and after all, ownership only matters if it comes with utility.

For Web3 to actually function as intended:

Digital assets must move freely across networks.

Identity credentials should work across ecosystems without

re-verification.

Tokenized assets need to be usable beyond their issuing platforms.

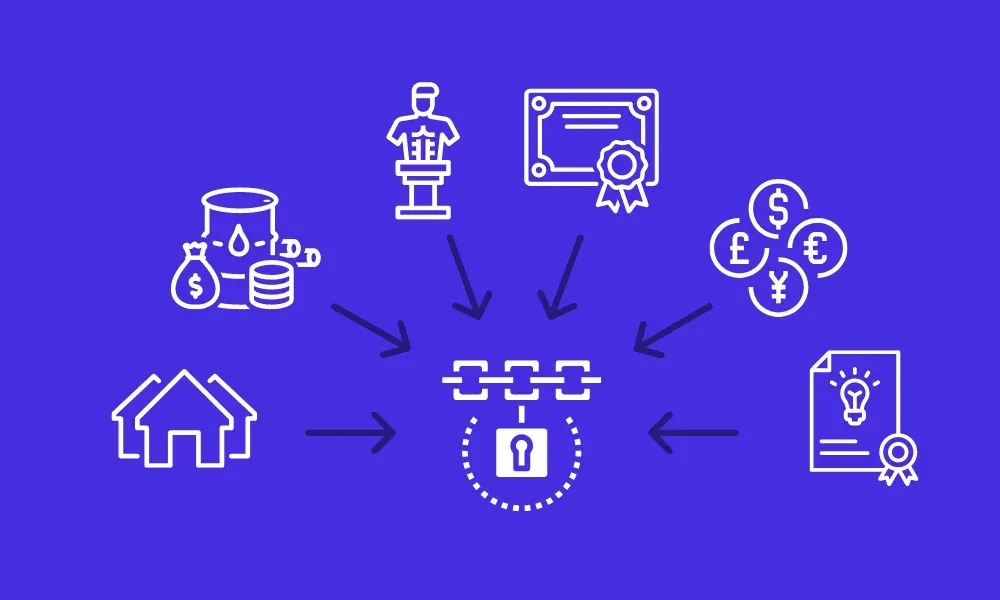

This is where programmable NFTs, DIDs and tokenized RWAs come in.

Uptick’s infrastructure enables assets to exist that aren’t confined

to a single blockchain. Whether it’s fractionalized real estate,

intellectual property, or supply chain assets, they remain usable

across multiple networks.

Web3 should be about making ownership practical, and if assets can’t

move and interact, we’re just adding extra friction to the same old

system.

Breaking Down Silos

Interoperability is what makes Web3 more than a collection of

disconnected chains.

Programmable NFTs take static ownership and turn it into something

dynamic. Built-in logic for leasing, royalties, and automated

conditions means assets aren’t locked into a single platform, and they

can adapt, interact, and function across multiple ecosystems.

Uptick’s W3C standard DID framework allows this to be pushed even

further. Instead of being tied to platform-specific logins, users

control their credentials and verify ownership across multiple

applications. This eliminates the need for centralized gatekeepers,

making authentication smooth across Web3.

The real issue, however, is blockchain silos.

Ethereum, Cosmos, Solana, and Polkadot were each built independently

with its own architecture, token standards, and consensus mechanisms.

What we end up with is fragmented liquidity, trapped assets, and

clunky cross-chain movement. Instead of complementing each other, most

networks still operate in isolation, slowing down adoption, and

promoting tribalism.

This is why scalable cross-chain infrastructure is so important, as a

way to create trust-minimized pathways for asset and data transfers.

What does that actually mean?

No more fragmented markets or restrictive bridging solutions. Just

enhanced liquidity, cross-network composability, and an open, unified

Web3 economy.

The Rise of a Unified Web3 Economy

Interoperability isn’t just a nice-to-have, it’s becoming the default.

More chains are integrating Inter-Blockchain Communication (IBC),

removing friction from asset transfers and making cross-chain

interaction smooth by today’s standards. Meanwhile, bridging solutions

are evolving, with trust-minimized designs reducing risks and

improving liquidity flow across networks.

This shift is changing how value moves in Web3.

Creators can distribute and monetize tokenized content across multiple

marketplaces while keeping full ownership and royalties.

Supply chains are moving on-chain, making real-time tracking,

automated settlements, and global trade more efficient.

Cross-chain lending and staking are eliminating single-chain

constraints, letting users put capital where it works best.

Web3 is reengineering financial systems, but without strong

interoperability, it risks repeating Web2’s mistakes with closed

ecosystems, isolated networks, and inefficiencies that slow

innovation. The next phase is standardizing digital assets so that

ownership remains fluid, practical, and economically viable across

industries.

Creating a True Web3 Economy

The Web3 ecosystem is shifting.

Despite a lot of the setbacks mentioned today, instead of chains

competing in isolation, they’re now finally starting to converge

toward shared infrastructure that prioritizes efficiency, security,

and scale.

Omnichain token standards like LayerZero’s OFT and ERC-6551 are

improving cross-chain interactions, but they don’t eliminate the need

for trust-minimized bridging solutions.

Liquidity aggregation is solving fragmentation, allowing assets to

move freely across networks while optimizing capital efficiency.

Uptick’s Cross-Chain Bridge (UCB) is bringing our own vision of

trust-minimized transfers to Web3, reducing reliance on isolated

liquidity pools and improving network connectivity.

Apps are also evolving beyond single-chain limitations.

Omnichain smart contracts now let users stake assets on one chain,

borrow against them on another, and trade without friction.

NFTs and other tokenized assets have moved past collectibles, and they

can now move across games, metaverses, and decentralized marketplaces,

unlocking a huge variety of new use cases.

The next wave of applications should be built without chain

restrictions, pushing the industry toward a truly open and

interconnected economy.

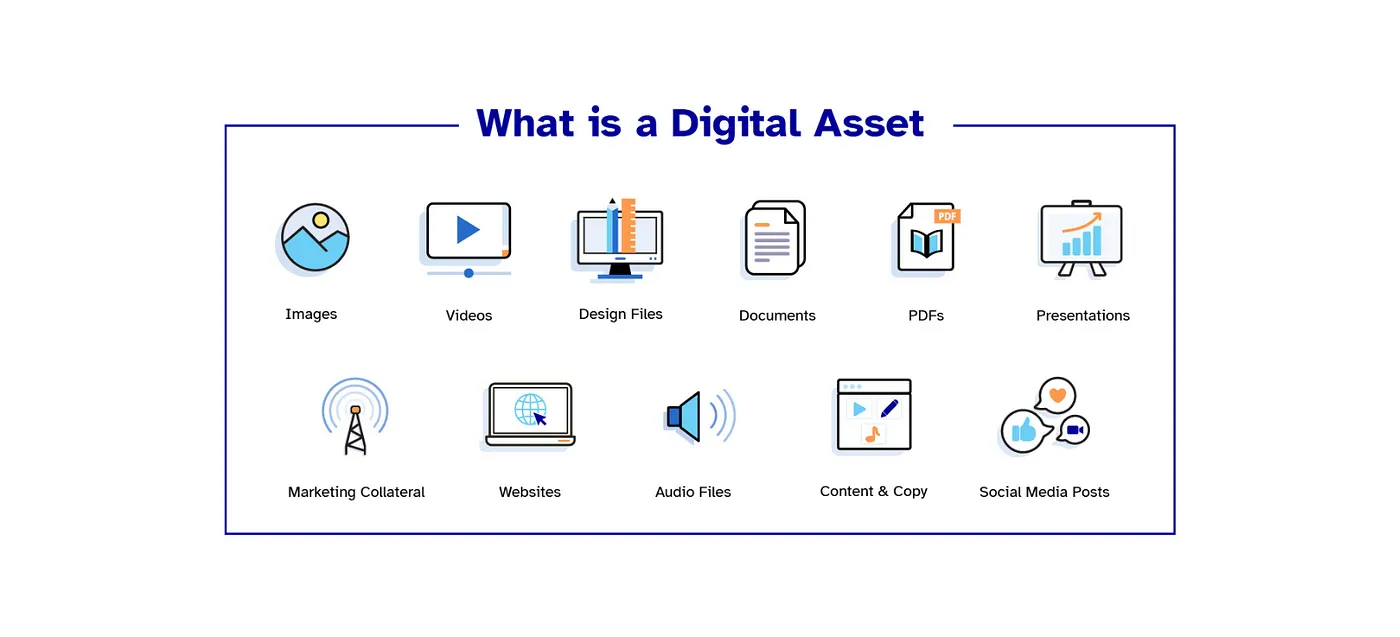

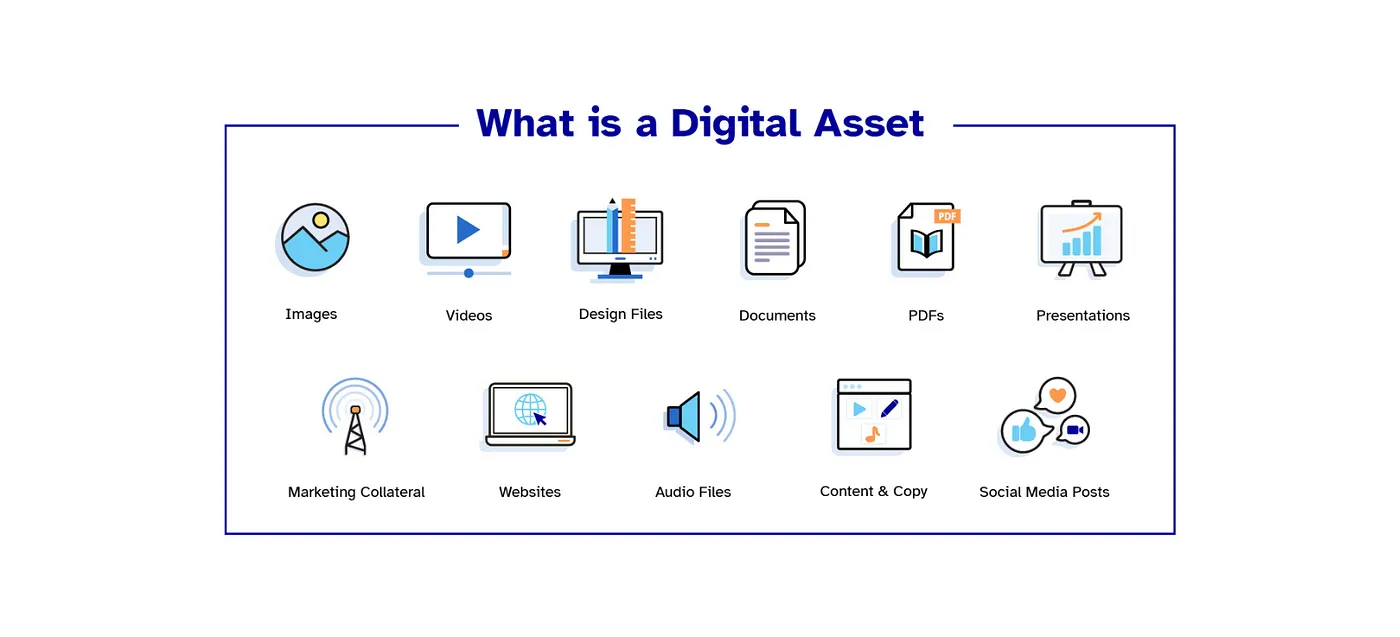

Standardizing Digital Assets for a Borderless Economy

Web3 is growing, but without standardization, it risks turning into a

tangled mess of siloed networks rather than a truly global digital

economy.

Right now, most assets are still trapped within their native chains.

Ethereum follows ERC standards.

Solana runs on SPL tokens.

Cosmos uses IBC-compatible formats.

Each ecosystem has developed its own framework, but without universal

standards, tokenized assets, whether NFTs, RWAs, or financial

instruments, struggle to move freely across networks.

It then becomes an issue of usability.

Can the asset function across different applications and ecosystems?

Does it retain its properties when moving between chains?

Can it transfer smoothly without complex conversions or liquidity

fragmentation?

Bridging assets from one network to another is one aspect of

interoperability, but it’s also about making them truly composable,

accessible, and economically viable everywhere.

In our eyes, that is the true meaning of interoperability.

Universal Asset Standards

Web3 is shifting from basic tokenization to making assets functional

across chains.

Without standardization, tokens remain locked in walled gardens,

forcing unnecessary workarounds. The goal now is creating cross-chain

assets that work the same way everywhere.

Token-Bound Accounts (ERC-6551)

Traditional tokens are just static ledger entries of ownership.

ERC-6551 changes that by turning tokens into self-contained smart

wallets. These can hold other assets, interact with dApps, and execute

on-chain logic, making them ideal for RWAs, gaming assets, and dynamic

financial instruments.

Omnichain Token Standards (LayerZero’s OFT, xERC20, ITS)

Bridging alone isn’t enough, and assets need to exist natively across

multiple chains. Standards like OFT (Omnichain Fungible Token) let

tokens operate across networks without wrapping, reducing

fragmentation.

The Role of Uptick Cross-Chain Bridge (UCB)

Interoperability is at the core of what Uptick is building. Uptick’s

Cross-Chain Bridge (UCB) enables trust-minimized asset transfers

across EVM ecosystems while keeping ownership fluid across networks.

Whether it’s moving NFTs, or in the future, RWAs, UCB lets assets

retain their integrity and functionality wherever they go.

A borderless Web3 economy should be about more than just better

blockchains, it should be about making digital assets universally

usable, and that means stronger cross-chain coordination, standardized

development frameworks, and infrastructure built for multi-chain

commerce at scale.

Moving Beyond Speculation

NFTs started as collectibles, digital art, profile pictures, and

cultural assets with limited real-world utility.

That phase was just the beginning. Now, tokenization is shifting from

speculative hype to a foundational technology that is reshaping

industries, some of which include:

Decentralized Loyalty and Rewards Systems

On-chain loyalty programs eliminate the inefficiencies of traditional

systems, enabling:

Tokenized rewards that can be earned, traded, and redeemed across

multiple brands.

Increased flexibility and liquidity through decentralized

marketplaces.

Cross-chain movement of assets, enhancing real adoption of tokenized

economies.

Uptick’s infrastructure strengthens these systems by supporting

efficient tokenization, interoperability, and real-world usability.

Supply Chain and Inventory Management

Tokenization is fixing broken supply chains, and on-chain systems

remove blind spots, enabling:

Real-time tracking of shipments and inventory.

Automated payments triggered by smart contract conditions.

Verifiable authenticity to combat counterfeiting and fraud.

On-chain data creates transparency and eliminates inefficiencies,

meaning that businesses finally have a trustless, auditable way to

track assets across global trade networks.

The Future of Tokenized Economies

The next phase of tokenization moves beyond collectibles into

financial systems, and as interoperability improves, tokenized assets

will enable:

Fewer intermediaries, reducing costs and delays.

Clearer ownership rights, cutting through legal complexity.

More transparent financial structures, providing accountability.

Tokenization is leaving behind its speculative roots and stepping into

a future where it powers commerce, finance, and ownership at scale.

Emerging Business Models

Tokenization is no longer just about putting assets on-chain.

It’s about automation, liquidity, and tearing down inefficiencies

baked into legacy systems. The old way, where transactions crawled

through layers of intermediaries is being replaced by automated

financial models that operate at speed and scale.

Businesses are already tapping into tokenized credit, decentralized

liquidity pools, and on-chain bonds without waiting for a bank’s

approval. DeFi is proving that capital markets don’t need middlemen to

function efficiently. With instant settlement and programmable cash

flows, blockchain-based finance is making traditional processes look

archaic.

Uptick’s tools allow tokenized financial instruments to maintain their

usability across multiple blockchains, turning them into viable tools

for real-world commerce. This expands adoption, enabling flexible

asset movement across chains while reducing friction. Liquidity is no

longer trapped within isolated networks, and decentralized liquidity

aggregation is making assets borderless, allowing them to flow freely

across ecosystems.

Traditional finance isn’t going away, but it’s being outclassed in key

areas. Automated and decentralized financial models are proving to be

leaner, faster, and more adaptable, and Uptick’s cross-chain asset

management solutions are pushing forward this transition, making DeFi

much more practical and scalable.

Beyond Crypto-Native Assets

Tokenization has moved past speculative crypto assets and is now

reshaping how businesses and individuals store, trade, and manage

value. Ownership is becoming fluid, assets are becoming programmable,

and traditional gatekeepers are losing their grip.

Real-World Asset Tokenization

From real estate and bonds to supply chain assets, tokenization is

turning illiquid holdings into tradable, on-chain instruments.

Uptick’s decentralized marketplace supports automated trade finance,

tokenization, and on-chain financial agreements, providing these

assets with a way to retain their liquidity across multiple

ecosystems.

Automated Finance and Revenue Distribution

Smart contracts have moved past the novelty factor, and are now

running real financial operations. From real-time royalty payouts to

automated revenue sharing, programmable agreements are replacing slow,

manual processes. Uptick’s infrastructure removes these

inefficiencies, giving businesses and creators full control over their

earnings without middlemen taking a cut.

Cross-Chain DeFi

Capital is moving beyond centralized banking rails. The new financial

architecture is automated, decentralized, and cross-chain. Uptick’s

infrastructure enables tokenized assets to move smoothly across

multiple networks, which improves financial flexibility and eliminates

reliance on fragmented systems.

NFT-Based Ticketing & Access

Events, content, and products are moving to blockchain-based

ticketing, eliminating fraud and giving creators direct audience

control. Uptick’s decentralized ticketing solutions power verifiable,

tamper-proof access.

Smart Payments & Lower Fees

Blockchain-based settlement slashes costs and cuts out reliance on

traditional processors, making payments faster and more efficient.

So, as you can see, tokenized business models are already here.

Automated finance, programmable ownership, and decentralized

marketplaces are operating at scale, and Uptick is building the

infrastructure to power this shift, making multi-chain transactions,

asset management, and Web3 commerce a reality.

Creating Indispensable Infrastructure

Crypto moves in cycles. Every bull run brings hype, and every bear

market filters out the noise, leaving behind the builders who push

Web3 forward.

We’re past the stage of proving concepts, Web3 is now about execution.

Scalability, interoperability, and usability are no longer theoretical

challenges; they are the deciding factors in whether Web3 becomes the

backbone of the next generation internet or remains a niche

alternative.

The goal isn’t to recreate Web2 with fancy blockchain branding. It’s

to build a new financial and commercial system that outperforms legacy

frameworks in efficiency, accessibility, and flexibility. A system

where assets move freely, ownership is programmable, and transactions

happen without unnecessary intermediaries.

Uptick is building the infrastructure to make that a reality, where

yes, Web3 is viable, but it’s also inevitable. The question isn’t if

Web3 will replace traditional models, but when.

And when it does, it won’t be because of ideology, it’ll be because it

simply works better. We believe that the future of Web3 adoption won’t

be won by speculation but by infrastructure that delivers a

frictionless experience.