Uptick Insight Series | 10 Ways RWAs Are Powering the Next Phase of

Web3 Adoption

Published on May 20, 2025

Speculation was where a lot of us started, but crypto really begins to

shine when assets we all know and love are able to connect to the real

economy and start to move alongside the systems we already have in

place.

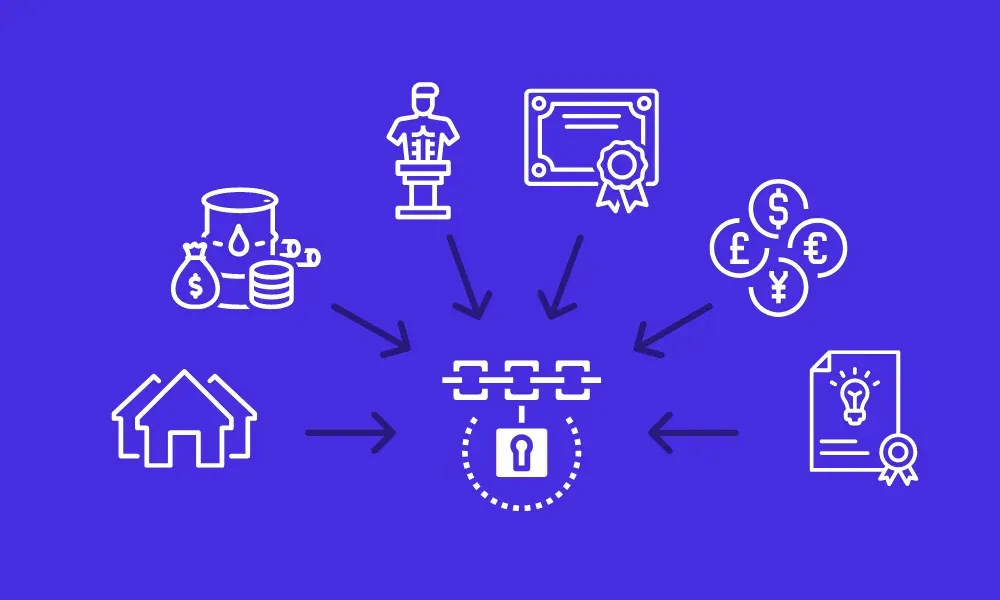

RWAs change how value is created, held, and transferred on-chain,

which can be anything from property, to invoices, to intellectual

property, essentially, anything that can be tracked, traded, and

programmed. We’ve now moved past the notion of simple representations

of existing assets, and it’s becoming more about how we can make

locked up capital more usable within an open, programmable system.

This article breaks down ten different models showing how real-world

assets are powering the next phase of Web3 adoption, and how Uptick

aims to support this important shift.

Intellectual property is one of the most valuable asset classes in the

world.

It’s also one of the more murky ones, because it’s often illiquid,

siloed, and difficult to price or enforce. Tokenization does things a

little differently, turning patents, trademarks, and copyright-based

revenue into programmable financial assets, where each token could

represent a share of a broader IP bundle.

The idea is that legal metadata such as jurisdiction, license scope,

renewal status, and expected revenue can be embedded directly, and

smart contracts handle the rest, routing royalties in real time,

triggering payouts based on usage data, and enforcing expiry or

revocation terms automatically.

High value IP portfolios can also be combined.

This allows fractional exposure to assets across a broad range of

industries such as pharmaceuticals, software, and consumer goods.

These tokenized bundles basically function like financial products,

bought, sold, and collateralized, with real revenue streams and legal

claims built in.

Uptick infrastructure is being developed to support this model, with

ecosystem tokens designed to carry usage terms and support modular

logic that developers could extend to reflect licensing scope,

jurisdiction, or revenue entitlements. Tools for asset verification

and compliance are in progress, and over time, intellectual property

may be integrated into the same programmable frameworks used for

assets like real estate or credit, structured, referenced, and traded

transparently on-chain.

Stay with me, now.

Farmland has always been a reliable store of value.

The problem is that it has rarely been accessible, with high costs,

legal complexity, and geographic barriers keeping most people out.

Tokenization, however, opens the gate, turning land ownership and

lease rights into tradable digital assets.

Investors get exposure to agricultural output without needing to

operate a farm.

In a scenario like this, tokens could represent legal titles, rental

contracts, or a share of crop revenue, all tied to real land

performance and enforced through legal agreements. Each plot could be

mapped on-chain with embedded data like location, yield history, lease

terms, and revenue distribution rules.

Farmers can unlock capital by selling fractional interests in

productive or underused land, creating liquidity without giving up

control.

Uptick is developing infrastructure to support this use case through a

rights-based asset model. Tokens could reflect usage entitlements and

structured revenue participation, and developers could define

real-world conditions that trigger programmable actions on-chain, such

as payouts or access updates.

The goal is to enable real-world outcomes to trigger automated

responses, using infrastructure that keeps the process transparent and

enforceable, without relying on intermediaries.

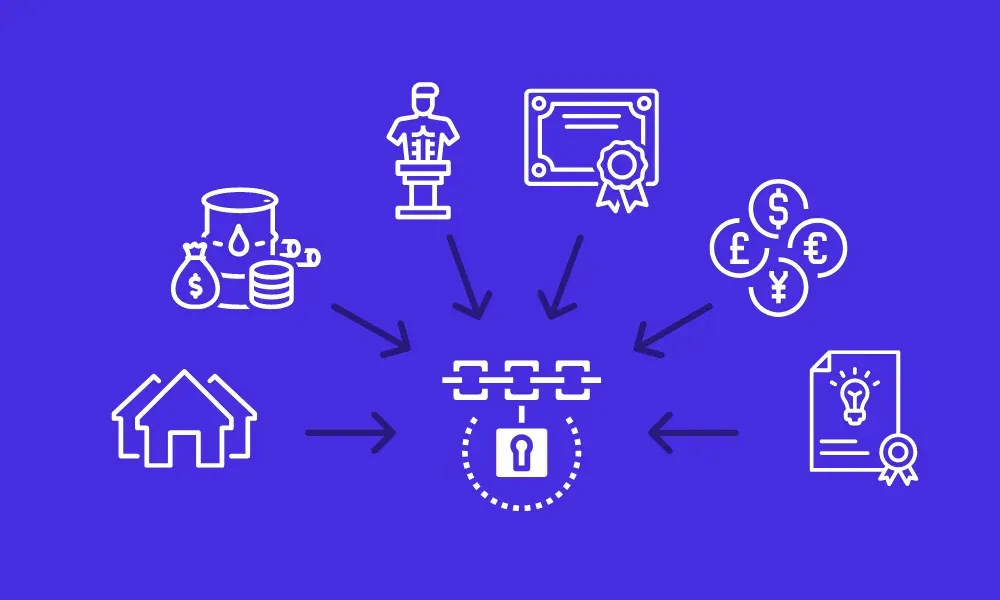

Public infrastructure takes a long time to build, and a lot longer to

finance.

Funding often relies on opaque concessions or slow-moving government

bonds, but tokenization opens that model up by turning

infrastructure-linked income into tradable financial assets, with

tolls, transit payments, and energy fees becoming programmable streams

of yield.

Each token represents a share of future revenue from a specific asset.

This could be anything from toll roads, to bridges, or utility grids.

Asset-level data like location, traffic volume, pricing models, and

payout terms can be embedded directly, and revenues flow to token

holders based on real usage and verified collections, connecting

physical performance to on-chain results.

Governments, city DAOs, or private operators could issue these tokens

to raise funds for new developments or refinance existing ones.

Investors gain access to yield from essential services without relying

on legacy municipal debt markets. The terms are transparent, the

returns are data-driven, and the capital can move more freely.

It’s important to make infrastructure-linked assets operable within

open networks, where real-world performance can drive automated

outcomes, and without losing the structure and accountability needed

for regulated use cases. Uptick is developing infrastructure that

could support this model, with tools designed to help developers build

permissioned systems, manage programmable payouts, and apply

compliance logic directly at the asset level.

Carbon markets are beginning to scale, but lots of people still rely

on paper-based validation that takes months to complete.

Tokenized credits make that process real time, syncing with sensors,

GPS data, satellite feeds, and live emissions tracking to reflect

actual performance on-chain. Credits can expire on schedule, subdivide

once used, or lock automatically when environmental thresholds are

breached. Each credit can carry its own logic, with embedded

parameters like regional rules, credit aging, and audit trails that

update as conditions change.

Stakeholders can issue different classes of sustainability assets,

some built for compliance, others for voluntary use, each governed by

its own structure.

Credits can support offset bundling, compliance tracking, and ESG

score integration, giving corporates real time proof of impact and

regulators a tamper-resistant record from issuance to redemption.

Programmable carbon assets can then enable incentives for verified

impact, insurance against project failure, and connectors between

fragmented climate registries. Credits can evolve as milestones are

met, update metadata over time, and trigger rewards or access when

tied to validated outcomes.

Uptick is developing infrastructure intended to support this model,

with architecture designed to be compatible with oracle inputs,

dynamic metadata, and future tooling for environmental efforts. The

goal being to give developers the ability to issue tokens that reflect

evolving conditions tied to verified actions, such as emissions limits

or tree planting initiatives.

This kind of infrastructure can support new forms of accountability

and coordination, where real-world outcomes are recorded, referenced,

and acted upon without needing centralized intermediaries. This also

opens up the ability to design incentive structures around measurable

progress, helping environmental projects demonstrate compliance,

trigger payouts, or unlock access based on on-chain representations of

off-chain activity.

Litigation finance gives investors a way to fund lawsuits in exchange

for a share of the outcome.

This is already gaining traction in traditional markets, but access is

limited, processes are slow, and the mechanics are hidden behind

closed agreements. Tokenizing legal claims taps into that space,

turning future case outcomes into programmable, tradable assets.

Each token can represent a share of a single case or a broader

portfolio, with terms built in from the start.

Jurisdiction, funding structure, settlement waterfall, and claim

priority can all be embedded at the asset level. Smart contracts

handle payouts once verifiable outcomes are reached, with oracles

supplying inputs like court rulings, filings, or public settlement

data.

Uptick infrastructure is being developed to support a structured

variety of digital assets with programmable terms, distribution logic,

and access controls that developers could tailor to specific use

cases. In models like tokenized litigation finance, this

infrastructure could help define how claims are represented and

managed on-chain, with external verification needed for any real-world

legal outcomes.

Assets with complex conditions should be modeled transparently and

tracked across networks, without overstating on-chain enforcement.

Tokenized real estate opens access to high value properties on a

global scale, but the real shift is in how ownership can be

programmed. Tokens can carry embedded fees, rent distribution logic,

region specific transfer conditions, and governance rights that evolve

over time.

Holding a token can generate income, unlock utility access, or enable

services like insurance.

Developers can tokenize pre-sales in stages, and buyers gain exposure

to portfolios that span multiple jurisdictions. Rules around voting,

upgrades, or resale can shift based on asset type, location, or how

long the token has been held.

Tenant activity, maintenance history, and community involvement can

feed into smart rules that adjust payouts or permissions in real time,

and escrows managed on-chain can handle reserves for repairs, energy

goals, or taxes, and fractional holders may receive utility credits or

temporary access when units are not in use.

Real estate becomes a programmable system for managing access,

distributing value, and aligning incentives across local economies.

Uptick is developing infrastructure to support programmable asset

models like these, with tooling intended to help developers build in

asset-level compliance, revenue tracking, and flexible permission

systems. In the future, conditions such as verified identity, holding

duration, or other on-chain signals could be used to shape how rights

and payouts are managed.

Over time, this infrastructure can support automation across parts of

the real estate lifecycle, providing transparency and control without

relying on centralized intermediaries.

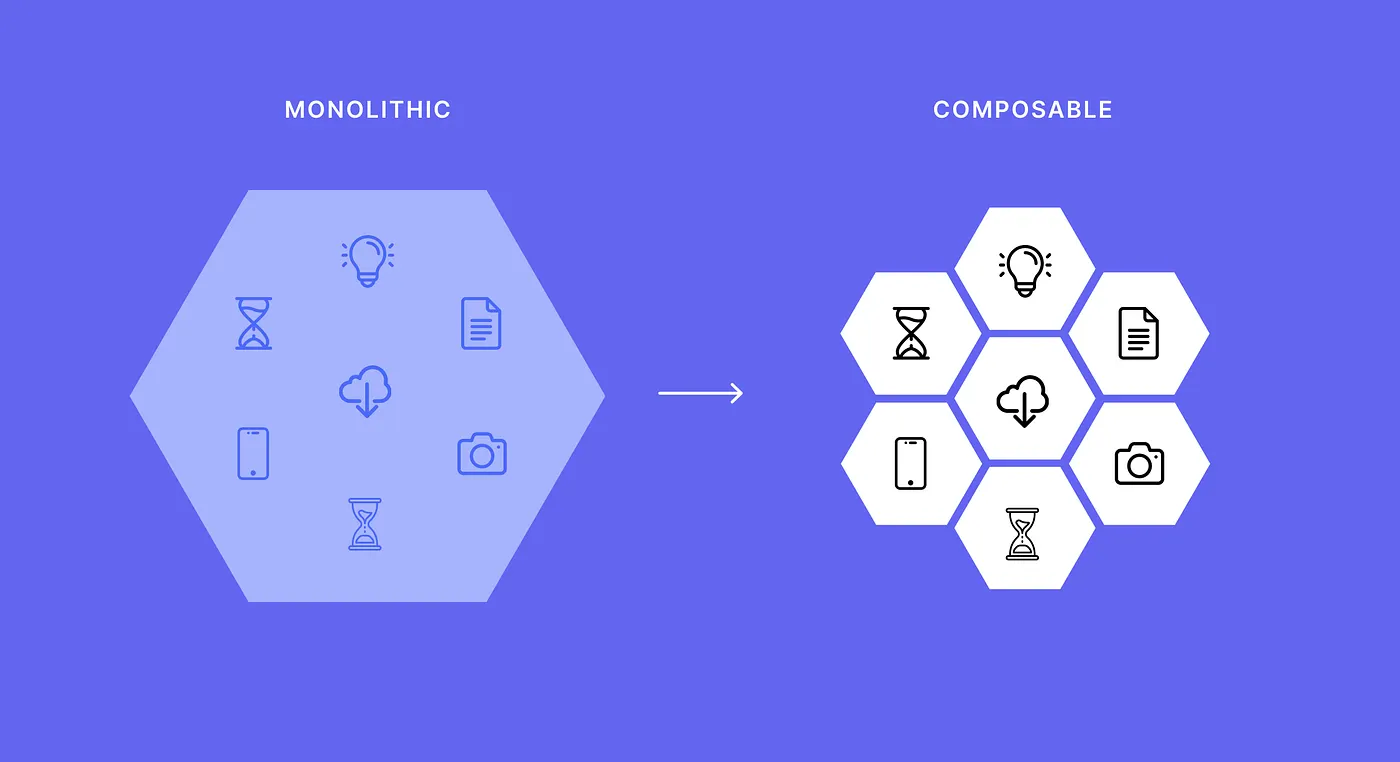

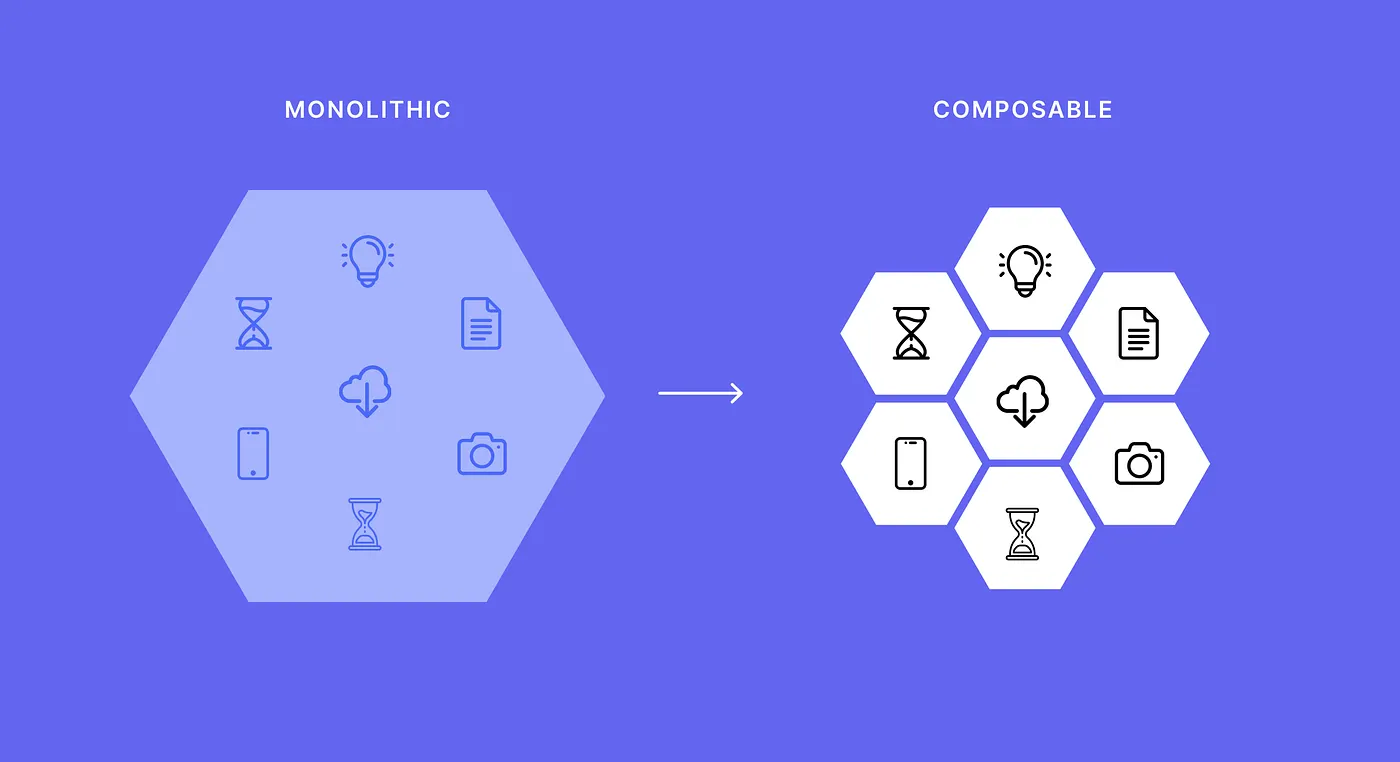

Collateral is expanding beyond crypto assets.

Tokenized invoices, IP contracts, equipment leases, and recurring

revenue streams can now support borrowing strategies, bringing

liquidity to assets that were previously difficult to finance.

Each token can carry logic tied to lock conditions, usage terms, and

performance-based scoring, giving lenders a clearer view of risk.

Credit pools become broader, repayments can be tracked through

oracles, and real time signals can trigger re-rating or liquidation

without manual steps. Assets can be structured into different risk

layers, or repackaged for resale, giving rise to flexible instruments

that adjust to market conditions.

New composable lending mechanisms emerge when these assets plug into

automated credit lines or yield strategies.

Lending flows can shift based on real performance, and capital can

respond instantly without intermediaries getting in the way. IP based

loans can adjust exposure based on royalty income, and equipment

leases can trigger insurance or upgrade rights when certain thresholds

are met.

These flows are coordinated by smart contracts that manage terms

between parties and keep everything running with less friction.

Uptick is developing infrastructure to support a number of different

programmable asset models with embedded terms, usage-based metadata,

and logic that developers can configure for collateral use cases. The

aim is to make it easier to represent repayment rules, usage

constraints, and eligibility conditions directly at the asset level.

Over time, this could enable more adaptive lending systems to be built

on-chain, without relying solely on crypto-native asset types or

manual oversight.

Private credit markets are starting to open up, allowing smaller

lenders and non traditional providers to access opportunities once

limited to large institutions. SME loans, invoice factoring, and

alternative equipment financing can now be tokenized, fractionalized,

and traded in open digital markets.

These tokens can reflect real terms tied to repayment timing, credit

tier, or borrower profile.

Yield strategies can adjust based on performance, and repayment data

can flow into dynamic models that react to actual borrower behaviour.

Loans become flexible assets that respond to changing risk, with the

potential for syndication, resale, and automated claim execution.

New participants can build pools focused on specific verticals, using

risk logic tailored to sectors like agriculture or creative work, then

governance logic can be structured via DAOs or smart contract-based

systems, and real-world signals like utility payments or inventory

levels can trigger changes to credit scores or repayment terms.

Uptick is building infrastructure intended to support this direction,

giving developers the tools to design programmable debt instruments

with embedded compliance logic and dynamic metadata. Capabilities such

as regional restrictions, KYC-aware permissions, and real-time status

updates can become part of the architecture, aimed at helping teams

create credit systems that are transparent, adaptable, and

interoperable across networks.

Bond markets are still held back by intermediaries, delayed

settlements, and fragmented infrastructure.

Tokenization provides a much cleaner alternative, turning fixed income

instruments into programmable assets that can be issued, tracked, and

updated in real time. Each token can carry embedded terms like

interest schedules, lock periods, redemption conditions, and

compliance requirements. Micro distributions become easier to manage,

and payouts can adjust based on contract rules, external data feeds,

or investor actions.

Features like KYC, time-based transfer rules, or escrow mechanisms can

be encoded directly into the asset.

This makes these tokens usable across institutional portfolios or DAO

treasuries, so idle capital can move faster, and income flows become

more transparent and predictable.

Uptick is building infrastructure intended to support programmable

financial instruments like tokenized bonds, with protocol-level tools

designed to let developers model internal states, integrate oracle

data, and manage distribution logic on chain. The aim is to help

create fixed income assets that can operate transparently and

efficiently within on-chain portfolio systems, without relying on

traditional custodians or clearing layers.

RWAs bring legacy assets on-chain in a way that completely changes how

they function, and with it, ownership becomes programmable, rules can

adapt over time, and value begins to reflect real world activity in

motion.

This has already started, as models are being tested, infrastructure

is evolving, and DeFi is finally starting to move past crypto-native

collateral. Uptick is building infrastructure to support this

transition, focusing on tools that allow assets to incorporate

compliance logic, automation, and cross-platform compatibility at the

protocol level.

The goal is to help developers design RWA models that function

natively in open systems and evolve with real-world economic activity

in a sustainable way.