RWA | Bridging the Tangible and Intangible

Published on Nov 14, 2023

RWA | Bridging the Tangible and Intangible

In a world where value is constantly redefined, just imagine how

society might shift if every valuable asset also held a unique space

in the digital world.

Let’s rewind slightly.

Historically speaking, the significance of assets was usually

determined by their ownership history, and often recorded on paper,

stored in vaults, or entrusted to centralized authorities. But as we

dive head first into this ever-evolving digital space, a notable

paradigm shift is looming:

Imagine being able to connect all of your real belongings, including

the artwork hanging on your wall or even your actual home, with the

digital world.

Enter the world of RWAs.

Real-world Assets (RWAs) have a dynamic lifecycle, and after being

acquired, they go through a series of transactions, each adding layers

of provenance, and often shaping their authenticity. Whether they are

sold, recycled, discarded, or passed down via inheritance, their

journey and history can be integral to their value.

Why would you want to do this I hear you ask?

Well, it opens up new possibilities for secure ownership, enhances

traceability, and allows for new and innovative interactions between

the physical and digital world. As technology advances, and RWA NFTs

develop further, we are breaking new ground by radically redefining

ownership and value.

It’s important to recognize that NFTs are a digital mechanism for

certifying uniqueness and ownership of any asset, including RWAs,

which are both tangible and intangible assets from our physical world.

Let’s explore how this technology intersects:

NFT stands for Non-Fungible Token

Imagine a digital collector’s item, like a rare online trading card or

a unique 1/1 piece of digital art. An NFT, is a special type of

digital certificate that proves you own that item.

Unlike Bitcoin, where every coin is the same (e.g: fungible), each NFT

is unique and cannot be replaced with something else (e.g:

non-fungible). It’s like having a signed painting — there’s only one

original. With blockchain, NFTs keep track of who owns these digital

items, making sure that the ownership is secure and cannot be copied

or faked.

In simple terms, NFTs are like collectibles for the new digital world,

proving you own a one-of-a-kind item on the internet.

A Real-world Asset (RWA) represents value that is anchored in the

tangible or legally recognized spheres of our world. These assets can

be physical entities, such as real estate, artwork, or machinery, that

you can touch and feel, but conversely, they can also be intangible,

like intellectual property rights, copyrights, or patents, which,

while not physically touchable, are recognized and protected by legal

systems.

So, while NFTs represent value in the digital world, RWAs have

intrinsic or legally backed value in the real world. They encompass

the everyday items we utilize, the properties we invest in, and the

rights we legally hold.

Essentially, RWAs are valuables, tangible or intangible, that aren’t

purely digital creations, and unlike the digital exclusivity of NFTs,

RWAs have direct impact and presence in our physical world or in

recognized legal frameworks.

Can you imagine a world where your grandfather’s vintage watch could

coexist seamlessly alongside your favourite piece of digital art?

Could you also imagine a future where the deed to your home is stored

safely in the same digital wallet as your sought after virtual

landscape created by a renowned digital artist?

When RWAs blend creatively with NFTs, the potential for innovation is

actually pretty endless. These innovations happen via tokenization,

which transforms physical assets into digital tokens and immutably

registers them on a public ledger known as the blockchain.

Assets get a unique digital identity which is impossible to duplicate,

giving them a fresh, new existence in the digital world. This is

incredibly transformative, as objects once firmly rooted in the

physical world now gain a dynamic digital fluidity. Along with this is

the added transparency, with every transaction, every trade, and every

interaction relating to these assets being transparently recorded and

easily traceable on-chain.

Let’s dive into some real-life scenarios to better grasp the

potential:

Imagine a local musician in Brazil wanting to tokenize their unique

compositions. Using Uptick in the future, they could effortlessly mint

these tracks as NFTs. Meanwhile, a music lover in New Zealand, keen on

backing new talent, has the opportunity to buy a stake in this

tokenized music, earning them a share of the royalties and directly

supporting the artist’s future potential.

The music composition, as an intellectual property, embodies both art

and potential revenue streams in the real world. By tokenizing their

music, the musician is able to plug into and engage directly with a

global audience.

This not only reshapes how we perceive value and ownership in the arts

but also builds bridges of collaboration across continents.

Shifting gears…

Picture a classic car aficionado who has chosen to tokenize their rare

1964 Maserati, a gem from their collection. By converting this

tangible asset into an NFT, they enable vintage car lovers worldwide

to invest in a fraction of the car’s ownership.

This removes geographical and financial barriers, and creates a much

more interconnected world for car enthusiasts and investors.

How about an up and coming filmmaker from Sri Lanka producing a unique

short film and deciding to tokenize their creation. A film enthusiast

in the UK, always eager to discover and promote fresh cinematic

voices, could then acquire a stake in this tokenized film, helping

fund future projects and connecting global audiences.

The film itself, as an intellectual property, holds intrinsic value in

the real world, and by tokenizing it, the filmmaker provides a digital

representation of this value, allowing for new forms of engagement,

investment, and distribution.

This isn’t just about buying music — it’s about owning a stake in

someone’s talent and future, and that is the beauty of RWA NFTs.

At Uptick, we see the vast potential of RWAs, and naturally our

infrastructure supports the underlying logic of this emerging asset

class. Over the coming months, our aim is to deeply enhance and

advance the business logic and application support that we believe is

necessary for RWAs, with an aim to build a solid foundation for lots

of exciting new use-cases. Our plan is to then aggressively advance

commercial RWA adoption as we move towards 2024.

Uptick Network is developing infrastructure across numerous domains,

with one of those being RWAs. However, in order to effectively support

this domain, comprehensive lifecycle management is essential.

Uptick is building several key features that are advantageous for

those exploring the RWA landscape, so let’s dive into some of the

technical functionalities on offer to support the ever-evolving world

of RWAs:

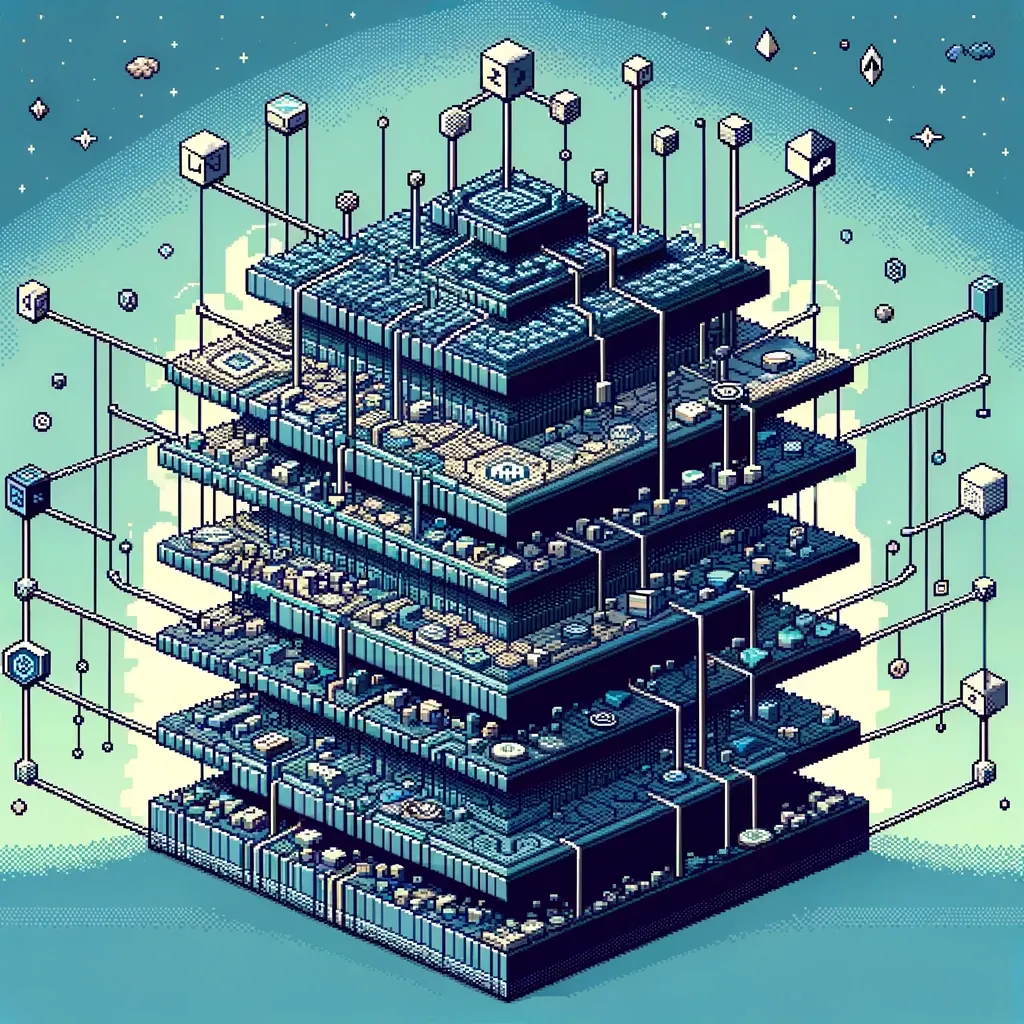

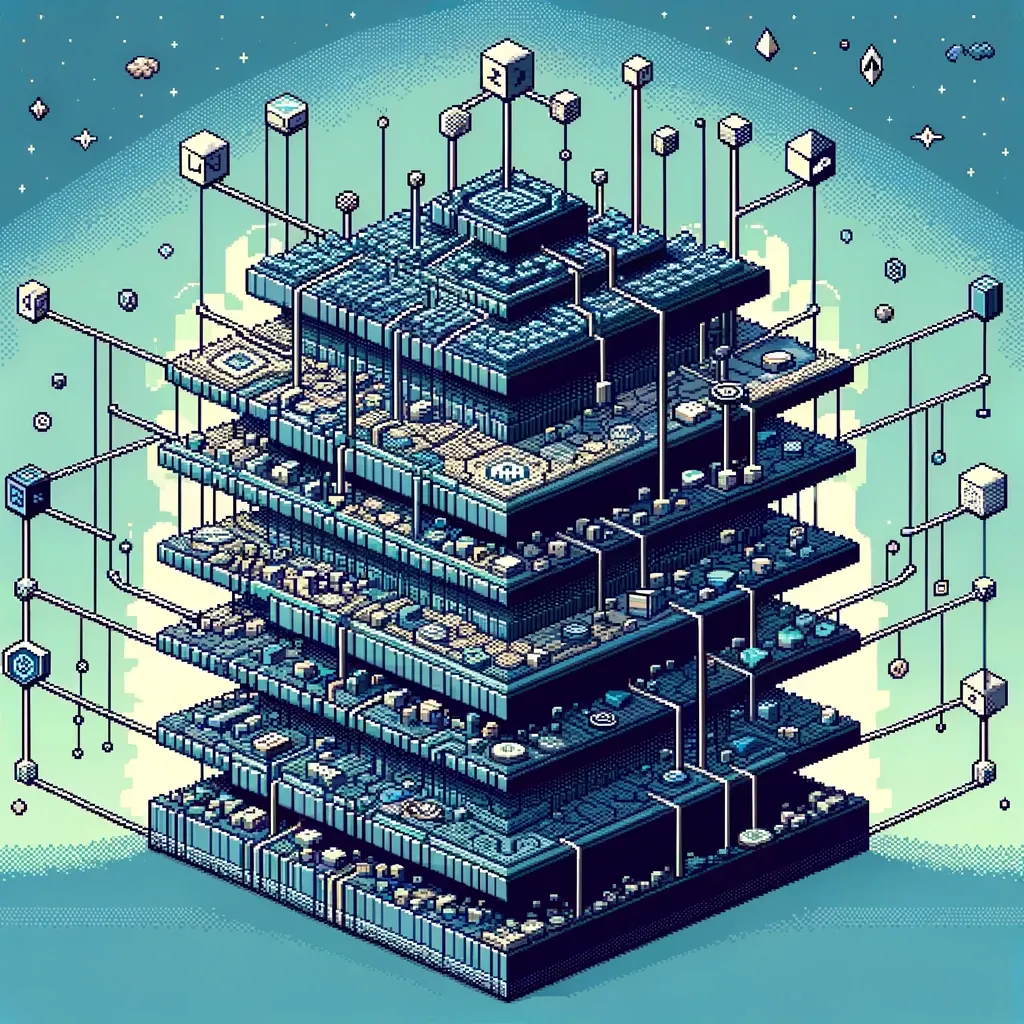

Uptick Network is a multi-layered architecture that can provide

flexible support for real-world NFT assets across various layers:

Base, Protocol, and Application.

Each of these layers are both modular and extensible, allowing for

tailor-made encapsulation and processing of different types of RWA NFT

assets.

This modularity is particularly significant at the protocol layer,

where unique business logics and management models of specific RWA

assets can be catered for.

This can range from everything from music, intellectual property, and

real estate, with each category requiring specific types of modular

support to address their distinct characteristics and requirements.

Uptick’s architecture aims to provide dedicated resources for every

stage of the RWA NFT lifecycle, from creation, to trade, to

management. When a new asset is tokenized, this process can be handled

in isolation from other stages, which ensures that the computational

power and storage required to create the token does not affect other

ongoing processes.

For instance, tokenizing an artwork wouldn’t clash with trading

another asset. This approach guarantees a more streamlined management

process, especially as more and more assets are tokenized.

With each layer focusing on a specific function, it enhances

reliability and reduces the risk of error, and for users, this means

quicker transactions and a much better experience, even in peak times.

Uptick supports communication across an array of different

blockchains. By utilizing bridges and relayers, it ensures that

information flows seamlessly, promoting interoperability. When an RWA

NFT is required on another chain, Uptick aims to facilitate its

migration while ensuring its integrity and ownership details remain

intact.

As the RWA NFT moves through its lifecycle, there might be instances

where it needs to be traded or accessed on different blockchains. This

level of interoperability ensures that the NFT isn’t confined to the

Uptick Network but can explore and utilize opportunities across the

vast blockchain ecosystem without compromising its history or value.

With technology such as UCB (Uptick Cross-chain Bridge) and IBC

(Inter-Blockchain-Communication), we are able to give the asset

extensive adaptability and versatility across an expansive multi-chain

ecosystem.

Uptick uses advanced cryptography to tokenize assets, transforming

them into unique one-of-a-kind NFTs. In the case of RWAs, this process

can ensure each asset is genuine and distinct.

In the lifecycle of an RWA NFT, we consider the issuance as the birth

moment, and we want the tokenized asset to retain all its unique

characteristics from the real world, making sure it’s an accurate

representation.

For this reason, digital twinning is vital for maintaining the asset’s

value and uniqueness throughout its lifecycle, and retaining an

asset’s value digitally ensures a deeper level of trust and maintains

the asset’s investment potential, allowing for transparent and

verifiable transactions in the marketplace.

Essentially, this is important because it preserves the integrity and

value of the assets as they transition between the physical and

digital world.

Finance revolves around various strategies for obtaining immediate

cash flow, securing future gains, or more effectively realizing

present value, and Uptick’s interface capabilities aims to allow

tokenized RWAs to be integrated with a number of various DeFi

platforms, such as DEX’s, lending protocols, and NFT marketplaces.

This will enhance their usability, and once an RWA is tokenized and

enters the digital world, its utility can expand. This ensures the RWA

NFT can transition from being just a digital representation to an

active financial instrument in the DeFi space, therefore amplifying

its utility.

This feature levels the financial playing field by allowing broader

access, and now even those who can’t afford entire assets like artwork

or property can invest in and benefit from a fraction of its value.

Looking forward, before an RWA might be tokenized within the Uptick

Ecosystem, we would ensure it would be subjected to a rigorous

validation process. This would typically involve third-party

validators or oracles, which are trusted entities or automated

verification systems designed to confirm the real-world attributes and

ownership of the asset.

This initial step is crucial.

Why, I hear you ask?

Because it ensures that only genuine and verified RWAs enter the

Uptick Ecosystem, which maintains the integrity of the platform and

enables trust among participants.

After tokenization, an RWA NFT isn’t static. It may undergo various

changes or transactions, and we want to ensure that every stage of the

asset’s life cycle, from issuance to potential redemption, is

manageable in an intuitive and secure way. This offers asset owners a

streamlined, all-in-one solution, and simplifies their management

process.

Post-tokenization, Uptick’s plan is to offer asset owners a wide array

of tools and interfaces, some of which include data insight, asset

tracking, and portfolio management. In the near-future, areas such as

liquidity provision and collateral management will be integrated,

providing optimized and effective asset management tools.

Given the sensitive nature of some RWAs, Uptick will incorporate

techniques such as zero-knowledge proofs, allowing for data

verification without complete exposure, and ensuring transactional

privacy, while maintaining the immutability and transparency of the

blockchain.

Our protocols will ensure that while the asset enjoys the benefits of

tokenization, sensitive details remain confidential, through its

active life in the digital world, until its possible redemption or

termination, and Uptick Network aims to ensure each phase is handled

with extreme care.

We believe this is incredibly important because privacy can

significantly boost the value of sensitive assets, for example in the

case of a confidential patent, or a proprietary trading algorithm,

etc.

With a multi-layered architecture, and specialized modules for a host

of different functionalities, Uptick provides an open infrastructure

that can support a variety of RWA types and their unique requirements.

Uptick is building detailed mechanisms to handle every phase of an

RWAs life cycle, from verification and validation before tokenization,

through management and trading, to potential redemption or

decommissioning. This comprehensive approach is essential for projects

dealing with RWAs, given the complexities associated with these

assets.

So, as we navigate toward a future where the line between the physical

and digital world becomes increasingly blurry, Uptick stands to be a

transitional bridge to a more interconnected Web3 landscape.

Why not join us for the ride?