Web3 Infra Series | Redefining ESG with Web3

Published on Mar 14, 2025

For the longest time, crypto has faced a lot of criticism over its

environmental impact. Many people called Proof-of-Work chains like

Bitcoin black holes of energy, consuming massive amounts of power in

the hunt for digital scarcity. Media coverage ran with this narrative,

framing blockchain as a completely unsustainable tech, burning through

resources at hellfire speed with absolutely nothing to show for it.

While it’s true that energy use is a fair criticism, these discussions

very rarely touched on the legitimate innovation happening in Web3 to

cut its footprint and create more sustainable economic models for the

planet.

Web3 is evolving faster than most industries, and while energy

efficiency is improving, that is only part of the story, as new models

are emerging around sustainable finance, carbon tracking, and

decentralized resource management, solving complex problems that were

too inefficient or simply impossible to address before. Businesses and

organizations are already integrating these models into real-world

sustainability efforts, and instead of relying on corporate

responsibility programs or unverifiable reports, they’re building

solutions that make environmental claims measurable and transparent.

This is made possible by elements such as tokenized assets, smart

contracts, and decentralized governance, which all have the potential

to bring accountability to sustainability efforts. Carbon reductions,

energy use, and resource management can now be tracked in real time

with immutable records. Sectors from agriculture to supply chain

logistics are using blockchain-based verification to eliminate

greenwashing (the practice of making false or misleading claims about

environmental impact) and establish real environmental accountability.

Web3 is restructuring sustainability efforts, and decentralized models

are proving their value, creating both economic and environmental

benefits. So, while the criticism isn’t baseless, it still barely

scratches the surface on what’s actually happening behind the scenes.

Let’s explore how this transformation is unfolding, how Uptick is

contributing, and what comes next for ESG (Environmental, Social,

Governance) 👇

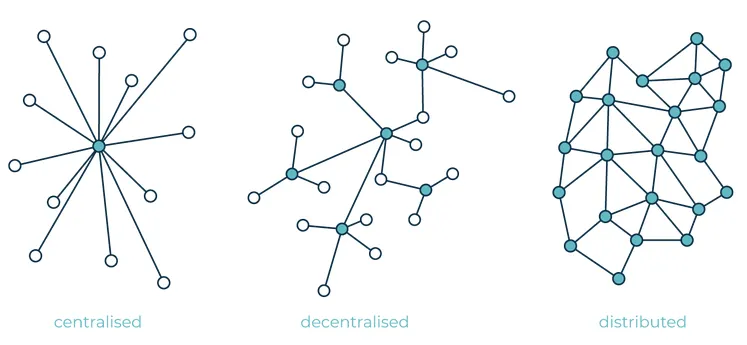

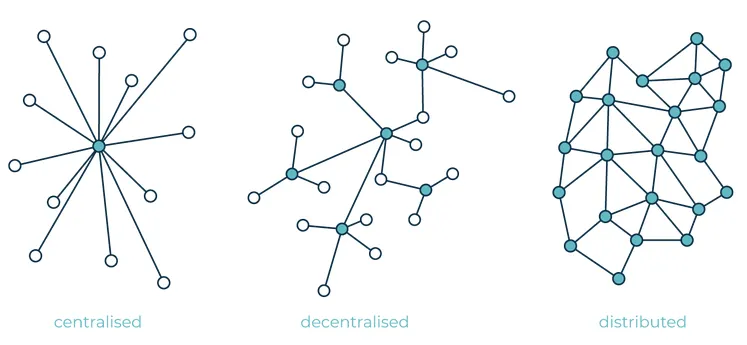

Centralized utilities have controlled energy markets for decades,

setting production, distribution, and pricing with very little

flexibility.

This model slows the adoption of new technologies and makes grids less

adaptable to shifts in supply and demand. Web3 introduces a different

approach by allowing direct peer-to-peer energy trading, giving

individuals and businesses more control over energy transactions.

Decentralized energy markets offer a way to balance fluctuating

renewable supply and rising electricity demand. Projects like the

Brooklyn Microgrid have already shown that peer-to-peer energy trading

works in practice, allowing homeowners to tokenize excess solar energy

and sell it directly to neighbors.

Other initiatives, such as Energy Web and Power Ledger, are expanding

these models beyond local communities. Instead of relying on

centralized grid operators, smart contracts can execute trades in real

time, meaning that energy flows where it is needed, based on demand.

While these projects do highlight the potential of decentralized

trading, regulatory frameworks are still one of the hurdles in

determining whether these markets can actually scale beyond pilot

programs.

How does it actually work?

Web3 makes decentralized energy grids possible by providing real-time

verification and automated settlements, reducing the need for manual

approvals and third-party oversight. With Uptick’s framework,

tokenized energy credits could be tracked and settled on-chain,

creating a transparent and verifiable record of energy generation and

transfer. Instead of relying on delayed reporting, every transaction

is recorded on an immutable ledger, allowing energy markets to operate

with real-time data.

Lower costs and more efficient distribution are some of the biggest

advantages of decentralized energy trading. Small-scale producers can

monetize surplus energy without relying on intermediaries, and

consumers benefit from fairer pricing. Uptick provides the framework

for this shift, meaning that every unit of energy traded could be

backed by on-chain verification, aligning with Web3 energy models

designed to optimize energy distribution and reduce inefficiencies in

the market.

Uptick Data Services (UDS) adds another layer of transparency,

addressing common issues in renewable energy markets such as fraud and

double-counting. UDS can provide verifiable on-chain tracking so that

every credit represents actual energy produced. To complement this,

Uptick’s DID system can contribute to verification by linking energy

credit transactions to identifiable sources, complementing broader

regulatory and data validation efforts.

Essentially, decentralized networks improve energy distribution by

balancing supply and demand dynamically, which means less waste, more

stable grids, and reduced reliance on large utilities.

Lowering emissions takes more than offset tracking; it requires a

different approach to energy production, distribution, and

accountability.

Web3 makes this possible by improving efficiency, creating direct

incentives for renewables, and turning carbon tracking into a

real-time, verifiable system instead of a process built on estimates

and corporate reports.

Energy Markets Without Bottlenecks

Traditional grids take time to adapt to shifts in supply and demand.

Pricing, distribution, and access are controlled by centralized

operators, limiting flexibility and slowing the transition to

renewables. This setup keeps small-scale producers locked out of the

market and creates inefficiencies in how clean energy is distributed.

Tokenized energy grids flip this model by removing bottlenecks and

letting producers of solar and wind energy tokenize surplus power and

trade it directly. Smart contracts process transactions instantly,

sending energy where it is needed without delays or intermediaries.

Instead of waiting on approvals or dealing with centralized pricing

structures, trades happen transparently on-chain, making energy

distribution faster, more flexible, and accessible.

Uptick strengthens this model by securing verification with a flexible

smart contract framework that keeps energy credits immutable and

tradable, but credibility still relies on verifying, so that each

credit reflects an actual unit of renewable energy. Transparent

validation at the issuance stage will be key to preventing market

distortions.

Uptick Data Service (UDS) can expand on this, bringing verifiable

tracking for tokenized sustainability assets, so that transaction

records stay transparent and auditable. As more regions start testing

decentralized energy markets, real-time tracking will be one of the

main factors in proving their reliability and getting regulatory

support.

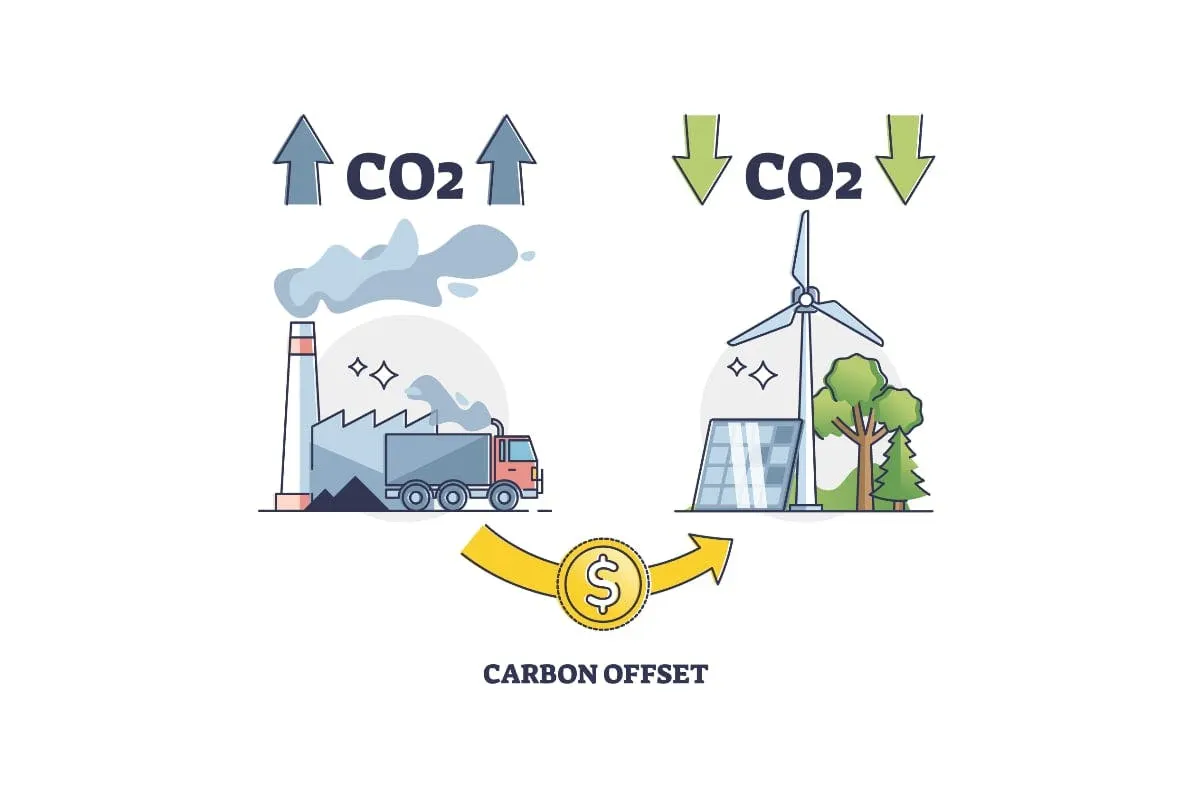

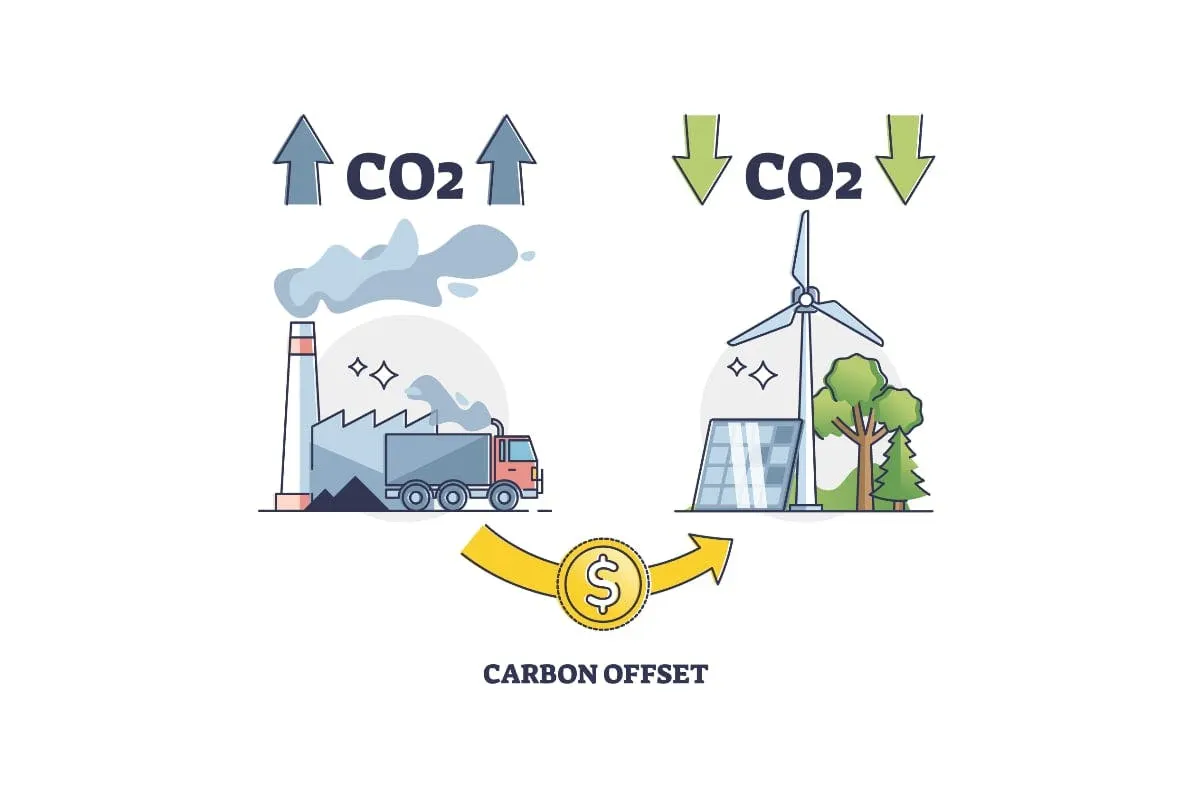

Verifiable Carbon Tracking

Carbon offset markets have a reputation problem, and many credits are

unverifiable, double-counted, or simply based on projections instead

of actual emissions reductions. A 2023 investigation by the Guardian

found that over 90 percent of rainforest carbon offsets issued by

Verra had no measurable impact, exposing the flaws in traditional

carbon credit systems.

Web3-based carbon tracking moves offsetting away from self-reported

claims to immutable, auditable records. One of the biggest ESG issues

is unverifiable carbon data, where corporations exaggerate or

manipulate sustainability metrics to meet investor expectations. With

every energy reduction, carbon removal, and emissions metric stored

on-chain, Uptick’s framework can enable the backing of offsets with

verifiable digital assets, reducing the risk of greenwashing.

Uptick’s system could support this shift by issuing tokenized carbon

removal credits based on real on-chain data, and not just estimates.

Also, with the integration of DID and ESG verification, supply chains

could link emissions reductions to actual energy use instead of broad

corporate pledges. Offset markets have always relied on corporate

disclosures and third-party verification, but Web3-based tracking

moves carbon accounting from a deeply opaque system to one that is

fully transparent and auditable.

However, and this will be a repeated theme throughout the article, in

order for this to work in practice, proper verification mechanisms

need to be in place before offsets are tokenized. Without strict

validation at issuance, even on-chain credits could fail to reflect

actual emissions reductions.

Tracking and Rewarding Daily Impact

Lowering emissions isn’t just about large-scale projects. Individual

choices also play a big role, but most sustainability programs offer

little incentive for action, and even even when they do, contributions

aren’t properly tracked.

On-Chain Proof of Green Actions

Uptick’s DID and verifiable data services will be able to enable

real-time validation of carbon reduction activities, shifting

sustainability tracking from unverifiable claims to auditable on-chain

records. With this in place, we can:

.Link sustainability data directly to real-world actions, eliminating

unverifiable claims.

.Give users a provable, on-chain sustainability record, reinforcing

credibility in ESG-focused ecosystems.

.Enable governments, businesses, and eco-conscious organizations to

offer incentives with full transparency, making sustainability efforts

measurable rather than relying on self-reported progress.

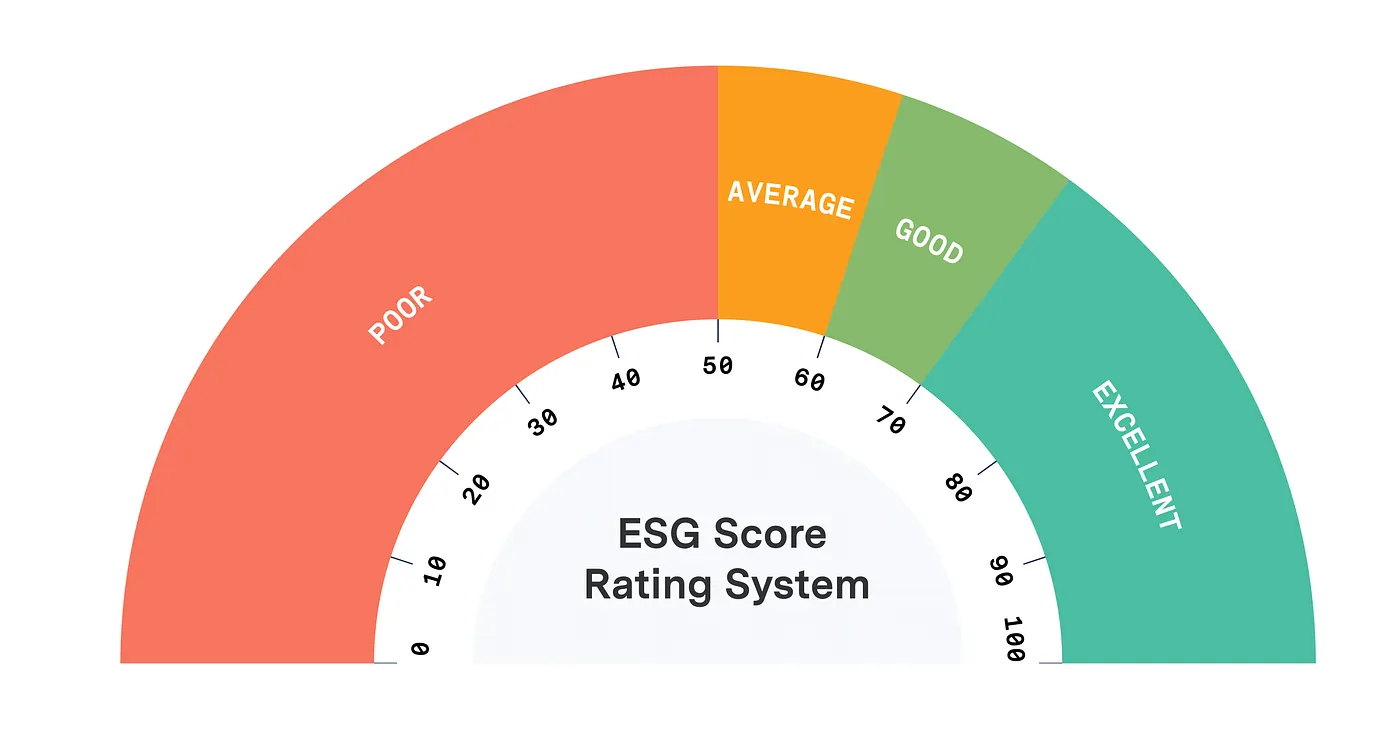

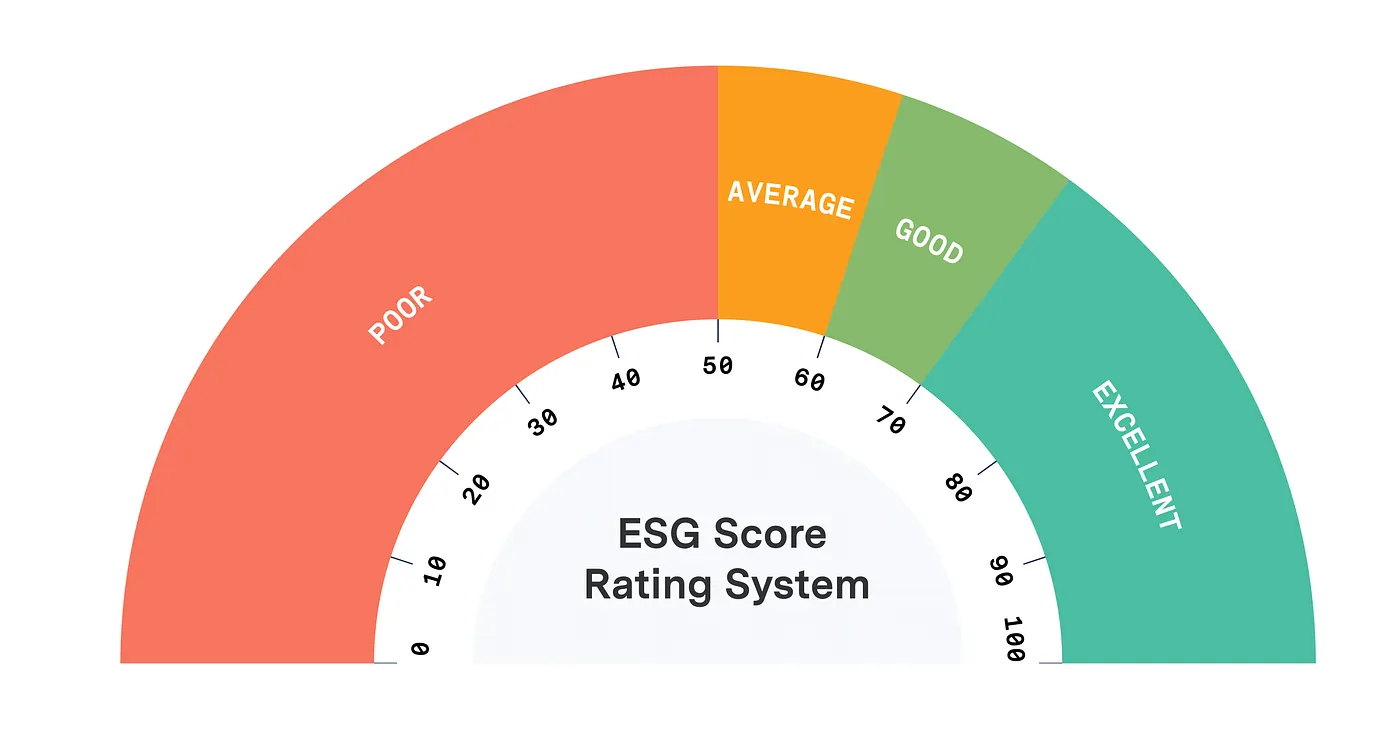

Traditional ESG ratings are built on self-reported disclosures and

third-party evaluations, making them easy to manipulate.

Companies frame sustainability data to fit investor expectations,

leaving out negative environmental impacts or shaping reports to boost

their standing. Even when audits happen, inconsistencies in

methodology and vague criteria make ESG scoring unreliable.

A 2021 EU Commission review found that 42 percent of corporate ESG

claims were misleading or unverifiable, which just goes to show how

easily these ratings can be skewed. On-chain ESG tracking has the

potential to make data timestamped, publicly auditable, and tied to

measurable environmental actions instead of marketing claims. However,

standardization is still an issue, and until ESG data feeds into

recognized regulatory frameworks, businesses will need hybrid

approaches that blend on-chain verification with industry-backed

reporting tools.

This lack of standardization is one of the reasons confidence in ESG

ratings is so low. Without independent, verifiable tracking,

businesses can shape sustainability reports without making real

changes, creating a system where investor and regulatory trust is

destroyed. Web3 introduces transparency, but its adoption still

depends on whether on-chain ESG tracking aligns with recognized

reporting frameworks.

Some organizations, including the Climate Action Data Trust, are

already developing blockchain-based registries to improve ESG

verification, but industry-wide adoption is still evolving. With

institutional investors and regulators moving toward stricter ESG

accountability, Web3-based verification is making sustainability

assessments continuous rather than periodic. Uptick is building the

infrastructure needed, so that in the future we can enable real-time

tracking of ESG actions, which means that sustainability claims are

backed by on-chain proof rather than unverifiable reports.

Tokenized ESG reputation directly links a company’s sustainability

score to its on-chain activity, improving transparency and reducing

the ability to manipulate ESG credentials through marketing efforts or

selective reporting. Businesses that consistently meet or exceed

sustainability targets will see its reputation strengthen, while those

that fail to take meaningful action will have a publicly visible

decline in their score.

In order for ESG reputation scoring to scale effectively, however, we

need clear industry standards that can provide consistency across

different frameworks.

Eliminating Greenwashing

Greenwashing has been a persistent issue in ESG investing, where

businesses exaggerate their environmental efforts to attract capital.

With Web3-based reputation scoring, corporate ESG narratives need to

match actual performance. Uptick’s DID and UDS could allow these

sustainability claims to be backed by cryptographic proof, eliminating

fraudulent ESG reporting, and introducing a much deeper level of

accountability.

This kind of real-time ESG verification also changes how investors

assess risk, and companies that previously relied on vague commitments

and unverifiable pledges will now have to back up their claims with

on-chain proof. Institutions allocating capital based on ESG

principles can analyze a company’s blockchain-tracked sustainability

history rather than relying on opaque reports or third-party ratings.

Cities are at the center of the sustainability challenge, accounting

for most of the world’s energy consumption and emissions.

At the same time, they hold some of the greatest potential for

innovation. The rise of smart cities is shifting sustainability from a

series of corporate initiatives to a real-time, automated process that

optimizes urban resources on demand.

Traditional environmental monitoring relies on reports that are often

outdated, unverifiable, or subject to manipulation. Web3

infrastructure changes this by enabling live tracking of energy use,

emissions, and waste management, meaning sustainability claims are

backed by provable, tamper-proof data instead of corporate

disclosures.

Data-Driven Sustainability

IoT sensors in cities already track air pollution, water usage, and

energy consumption, but much of this data is locked within centralized

institutions. If this data is integrated into decentralized networks,

smart cities could shift sustainability efforts from static reporting

to automated, real-time enforcement without relying on intermediaries.

A smart grid, for example, can instantly adjust to shifts in supply

and demand. Buildings generating excess solar power wouldn’t need to

wait for a centralized provider to process transactions. Instead,

on-chain peer-to-peer energy trading could allow surplus energy to be

sold directly, creating a much more fluid and efficient renewable

energy economy.

This model extends to recycling efforts too, as these programs

frequently suffer from fraud, inefficiencies, and improper disposal,

with many materials ending up in landfills instead of being properly

recycled. Web3 integration makes it possible to track waste from

collection to processing, verifying that materials are actually

recycled rather than discarded. This shifts sustainability from

corporate pledges to a transparent, automated system where

environmental impact is recorded in real time and directly tied to

incentives.

As more cities adopt Web3-powered sustainability models, environmental

accountability will no longer be a matter of trust. It will be deeply

integrated, verifiable, and self-sustaining, transforming into a

system where sustainability efforts are accurately measured, rewarded,

and enforced without relying on external oversight.

Carbon offset markets are plagued by credibility issues,

inefficiencies, and unverifiable claims.

Many carbon credits are based on projections rather than actual

reductions, and cases of double-counting, overstatement, and outright

fraud have destroyed a lot of the trust in these systems. Corporations

buy offsets to meet sustainability targets, but without transparent,

standardized verification, proving that these offsets represent real

emissions reductions is nearly impossible.

Web3 offers a way to fix this at the source. Replacing centralized

oversight with on-chain verification and automated validation moves

carbon offsets away from loosely monitored credits to provable,

immutable records of environmental action. With ESG standards

tightening, decentralized verification is already aligning with

frameworks like the Paris Agreement targets and Science-Based Targets

initiative (SBTi), reinforcing accountability at scale.

The Problem with Traditional Carbon Markets

Current carbon markets rely on third-party verifiers, self-reported

data, and opaque crediting mechanisms. A company can claim carbon

neutrality by purchasing offsets, but verifying whether those offsets

represent real reductions is a massive challenge. Some credits are

sold multiple times, while others fund projects that fail to deliver

any measurable environmental benefits.

Web3 eliminates this issue by tying every credit to a unique,

verifiable reduction in emissions. With decentralized tracking, each

issued carbon offset is stored on-chain, timestamped, and publicly

auditable. Smart contracts prevent duplicate claims, making any

attempt to resell or misrepresent a credit immediately verifiable.

Traditional offset systems also involve long approval processes and

expensive intermediaries, driving up costs and making participation

difficult for smaller sustainability projects. Local organizations,

community-driven reforestation efforts, and small-scale carbon

reduction initiatives struggle to get access due to bureaucratic

constraints and high entry barriers.

Transparent and Verifiable Carbon Offsets

Decentralized carbon offset verification removes ambiguity and trust

issues by linking carbon reductions directly to on-chain records.

Instead of relying on unverifiable corporate disclosures, Web3 offsets

are issued, tracked, and audited in real time, meaning every credit

corresponds to actual, measurable emissions reductions.

Uptick’s infrastructure aims to strengthen carbon offset integrity by

supporting decentralized tracking, validation, and storage of

emissions data. With real-time verification via Uptick Oracle, which

is planned for future development, sustainability initiatives could

document carbon sequestration efforts on-chain. However, since the

accuracy of these records still depends on reliable data inputs,

emissions reductions must be properly verified before tokenization.

Uptick DID integration also prevents unverified entities from issuing

or trading offsets, blocking duplicate claims and reinforcing market

credibility. With an immutable record of carbon reductions, offset

markets shift from opaque transactions to fully transparent, traceable

sustainability contributions.

If offset verification moves to transparent, decentralized ecosystems,

Web3 opens the door to broader participation and fairer pricing. Local

sustainability projects, individual carbon reduction efforts, and

small-scale reforestation initiatives could issue verifiable offsets

without navigating centralized approval bottlenecks.

Businesses and investors could then support projects with verifiable

environmental impact instead of relying on third-party ratings or

unverifiable corporate reports. Uptick infrastructure could improve

the transparency of carbon offsets, supporting a shift from

speculative markets to more verifiable sustainability contributions.

Voluntary sustainability reports offer little accountability.

Web3 removes this issue by recording emissions, resource use, and

compliance data on-chain, making verification immediate and

tamper-proof. Companies can log carbon emissions and offsets in a way

that prevents manipulation, track product life cycles from

manufacturing to disposal, and automate ESG compliance through smart

contracts that remove enforcement delays.

Uptick infrastructure aims to support ESG tracking by eventually

integrating supply chain data, carbon accounting, and compliance

reporting into a single decentralized system. This would eliminate

unverifiable claims and provides real-time transparency, allowing

sustainability efforts to be tracked without relying on corporate

disclosures.

Verifiable ESG Reputation Systems

Without clear accountability, fraudulent projects dilute the impact of

real sustainability efforts. Tokenized reputation systems assign

credibility scores based on verifiable data, making ESG impact

measurable over time. Investors, regulators, and consumers can assess

sustainability efforts dynamically, rather than relying on

unverifiable claims.

Uptick’s Decentralized Identity (DID) and Verifiable Credentials (VCs)

can provide a transparent framework for ESG profiles, allowing

businesses and sustainability projects to establish verifiable

environmental claims. These records allow investors and regulators to

evaluate ESG performance before allocating capital, reducing a lot of

the reliance on self-reported metrics.

Automated ESG Compliance

Traditional ESG regulations rely on slow enforcement mechanisms such

as fines and subsidies. Web3 removes these inefficiencies by

automating compliance through smart contracts, making sustainability

enforcement immediate and transparent. In the future, companies using

Uptick’s framework could track emissions compliance in real time,

reducing delays in reporting and verification.

Financing rates could also adjust dynamically, rewarding businesses

that meet ESG targets with lower costs. Uptick’s programmable

governance and treasury mechanisms could support capital allocation

based on on-chain impact metrics rather than corporate pledges.

Instead of unverifiable commitments, Web3 ties sustainability efforts

directly to financial incentives, shifting ESG accountability from

marketing claims to measurable results.

Web3 is cutting through the noise of ESG claims, turning

sustainability from a branding exercise into something provable.

For way too long, corporations have thrown out vague commitments

backed by reports that no one can verify, but fortunately, this period

is coming to an end.

Uptick is actively building the infrastructure to make ESG reporting

data-driven, trustless, and verifiable. Decentralized identity,

provable credentials, and automated tracking have the potential to

replace self-reported claims, creating an objectively better system

that reflects real-world progress, and not just empty marketing copy.

Companies won’t just be writing sustainability reports to tick

compliance boxes, they will be integrating on-chain infrastructure

that ties ESG goals to measurable impact.

Until now, sustainability has been driven by unverifiable reports,

self-reported metrics, and corporate pledges that rarely translate

into real action. ESG used to be about unchecked promises, but now

Web3 finally has the chance to make it about what matters most:

on-chain proof.