Web3 Infra Series | Building Native Stablecoins for a Usable Internet

Published on Aug 26, 2025

Despite the long presence of the stablecoin in Web3, native ones still

tend to get sidelined on app-focused chains. Most of what’s out there

today is bridged in from somewhere else, with tokens seemingly

duct-taped across ecosystems that were never quite built to operate

natively. That creates friction because stable value is essentially

the base layer for any system that wants to support real activity tied

to the economy.

This piece breaks down where bridged stablecoins fall short, what real

infrastructure needs to deliver, and how Uptick is building toward a

native model where stable value sits inside the stack itself, embedded

directly into applications, marketplaces, and settlement layers.

So, what is a stablecoin?

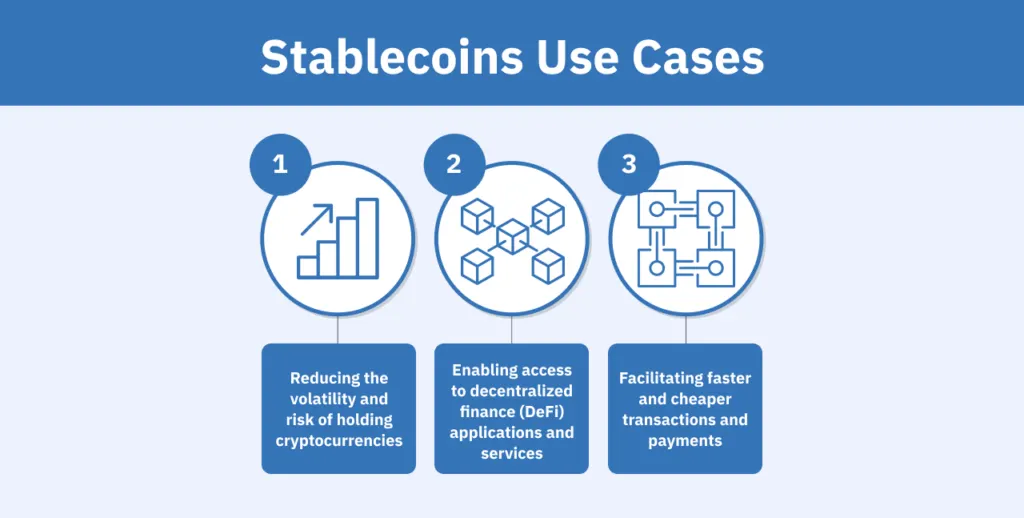

Stablecoins are digital currencies built to hold steady value, usually

pegged to fiat, real-world assets, or managed algorithmically. This

gives them the stability needed to handle value transfer in actual

transactions, without getting dragged around by market volatility.

In practice, however, most of the stablecoins people use today aren’t

truly native. Bridged assets have kept things afloat thus far, but

because they’re brought in from other ecosystems, they rarely feel

integrated into the systems they’re being used on, and the weaknesses

start to become obvious the moment you try to build anything

substantial on top of them.

There are a few different stablecoin designs.

Some are backed by fiat reserves like dollars or euros, others are

tied to commodities such as gold or oil, some rely on crypto as

collateral, and a smaller, more controversial group uses algorithmic

controls to hold their peg.

Most daily activity in DeFi still relies on fiat-backed coins like

USDT and USDC, but these depend on issuer trust and reserve

transparency, which are constantly under scrutiny. Even when the

mechanics work as intended, these coins often sit awkwardly on top of

the system instead of operating as native components you can reliably

build with.

If Web3 wants to support real economic activity, it needs stablecoins

that are composable from the ground up and actually feel like part of

the chain’s core logic.

That need is only becoming more important as the market itself grows.

By 2025, the stablecoin market has pushed past $250 billion, with USDT

and USDC making up the majority. These assets are seeing more

real-world payment use, getting pulled into TradFi and serving

practical roles outside of crypto. This rising adoption makes the case

for infrastructure that treats stablecoins as native building blocks,

which is where Uptick is directing its focus, developing systems that

let them function inside applications, marketplaces, and settlement

environments by default.

At this point, the challenge is less about design and more about

durability, because infrastructure needs to hold its value when

activity accelerates, and the systems built on top need to support

users without relying on bridges or fragile third-party logic. Without

that solid base, there is a real danger of Web3 staying stuck in its

own echo chamber, cut off from real economic participation.

If you think about it, bridged stablecoins were always more of a

stopgap, and never really built for long-term use.

Disconnected from native modules and poorly integrated with

chain-level logic, they’re difficult to use in systems that rely on

modular components like NFTs, credentials, or programmable payments.

The result is an ecosystem that feels like it’s been assembled in the

wrong sequence. Connections between apps feel unreliable, and value

transfer often breaks in ways that force developers to patch things

manually instead of building with confidence.

Bridges also introduce extra security assumptions that are hard to

ignore. When value crosses into unfamiliar systems, users start to

hesitate, unsure if their assets will stay safe or usable across

applications. That uncertainty adds friction and essentially slows

down everything around it.

On top of that, bridged tokens spread liquidity across chains, force

awkward user paths, and essentially end up interrupting composable

development. It becomes harder to coordinate pricing, model stable

flows, or keep experiences consistent across time. Workarounds stack

up, technical debt builds, and every extra integration layer adds a

little more drag to the system.

To combat this, stablecoins need to function as part of the

infrastructure, rather than external add-ons. Without that, payment

layers stay disconnected from the systems they’re meant to support.

These assets should be embedded in governance, loyalty, access, and

reputation from the beginning, rather than just added later as

isolated integrations.

Native stablecoins reset our sense of what the baseline is.

For example, when issued directly on a chain like Uptick, they stop

being a workaround and start behaving like part of the system itself.

No wrappers, no bridges, just clean integration where they are able to

flow through NFT sales, fan memberships, DAO activity, and

credential-linked actions without breaking anything.

That’s the point where stablecoins start to function as

infrastructure, built to support real systems rather than forced into

place, pushed through frameworks they were never really designed for.

As soon as they move into the core stack, the expectations shift from

technical integration to legal and regulatory weight.

In places like the US and Hong Kong, issuers are now facing very

strict requirements around licensing, reserves, and audits, which

makes regulatory trust just as important as technical integration. The

US framework is designed to consolidate stablecoin issuance under

large, dollar-anchored players, and Hong Kong supports a

multi-currency model aimed at regional trade and overseas payment

flows. Together, these approaches show how regulation is shaping

stablecoins into compliant infrastructure, and why credibility has to

sit alongside composability if native systems are going to work.

Without that layer of trust, the technology isn’t enough on its own,

but when compliance and credibility are in place, value stops moving

in fragments and flows as part of a continuous system. Payments become

programmable, marketplaces can default to stable pricing, fans gain

access in local equivalents, loyalty rewards settle in units that work

across platforms, and the stablecoin shifts from an external add-on to

a core part of how the system moves.

The architecture also gets easier to scale once stable value becomes a

core building block. Financial logic stops breaking between apps, and

consistency starts to rear its head across tools. Microtransactions

don’t rely on fragile routing setups, streaming payments run with

fewer moving parts, and new projects can launch with built-in payment

rails instead of wiring them from scratch.

This gives developers more room to move, with faster iteration, fewer

roadblocks, and a system that supports experimentation instead of

slowing it down.

Essentially, native stablecoins bring real-world logic closer to the

design of on-chain systems, where subscriptions, timed payouts, and

localized pricing can be implemented with much less overhead, so a

creator can price content in stable currency equivalents that hold

across markets, and entire ecosystems can settle on a single pricing

layer that works across apps and user flows without introducing hidden

costs or constant breakpoints.

With that in place, value becomes as composable as data.

Commerce runs on stable value.

If the goal is to support trade, creator sales, ticketing, or

app-native marketplaces, the medium of exchange has to live inside the

system, and without that, payments turn into a hodgepodge of wrappers,

plugins, and fragile logic that users don’t trust and developers can’t

build around.

These are the constraints that keep Web3 stuck at the edges, because

there are too many tradeoffs, too much overhead, and no clean path

toward real economic activity.

Uptick’s architecture is already built around on-chain commerce, and

native stablecoins are the natural next step, enabling cross-chain NFT

pricing, predictable settlement units, and payment flows that actually

behave like payments. No swaps just to make a purchase, and no

wrapping or waiting, just direct, stable exchange.

Native stablecoins make on-chain payments competitive, because

settlement is instant, and transaction fees often stay under 1

percent, which is a clear improvement over the 3 to 5 percent cut

taken by traditional processors. Lower cost essentially removes

friction, because merchants can accept payments without

intermediaries, users interact with fewer barriers, and commerce can

then flow more naturally between platforms.

It also brings predictability as sellers don’t need to walk users

through which token to use or how to make the payment work, buyers pay

in familiar currency equivalents, and developers can apply the same

payment logic across environments without rewriting everything.

Creator platforms, fan economies, and tokenized real-world assets

benefit from this structure too, as stablecoins act as both the

exchange layer and the settlement layer, which gives businesses the

ability to stay on-chain without dealing with volatility risk or

integration overhead.

As real-world assets such as property, intellectual rights, or

fixed-income instruments move on-chain, the pursuit of price stability

becomes unavoidable, and that’s where native stablecoins enter the

fray, making it possible to support fractional entry, automate

distribution, and keep reinvestment in a single unit of account.

Bridged tokens hold that process back, introducing delays, increasing

risk, and complicating user flows, whereas native stablecoins remove

those points of friction and give users a clear path to interact

without hesitation, which is what functional economic activity looks

like in Web3. Payments follow familiar logic, value exchange holds up

across apps, and the system becomes easier to use, easier to trust,

and ready for growth.

Once stablecoins are native, they stop acting like passive money and

start becoming programmable.

This changes how value moves through a system, and it means

stablecoins can react to user behavior instead of just transferring

funds from point A to point B. We have tools that can be staked,

locked, or layered with permissions that are able to respond to

identity, reputation, or smart access rules.

It also gives developers a way to design money systems that actually

reflect how people use applications. Loyalty programs can settle in

stable value, reputation layers can apply penalties or unlock rewards,

and dynamic pricing models can connect directly to stablecoins that

hold steady under pressure. That level of stability makes automation

reliable and gives systems a foundation for connected, multi-layered

interactions.

In the context of Uptick, native stablecoins have the potential to

unlock applications that move value across governance, fan access,

creator perks, commerce, and more, using a currency that feels a lot

more familiar to the everyday user. They could also connect with

payment interfaces, fiat onramps, and mobile-first flows, expanding

accessibility far beyond crypto-native environments.

These developments help stablecoins function as a reliable base layer

for applications and turn passive infrastructure into something

consistent and usable.

Within the Uptick Ecosystem, this alignment strengthens how value

moves through its architecture, reinforcing it as a system designed

for practical use. Once stablecoins are fully composable, they stop

acting like a separate layer, and they become the link between

modules, connecting apps, services, and users through shared logic

that extends way beyond payments.

Momentum across the industry shows this shift is already underway.

In August, Circle announced Arc, a new Layer 1 chain built around USDC

as the native currency. Arc removes the need for a volatile gas token

entirely. Every transaction, contract, and payment runs directly on

stable value, rather than a speculative asset, so the stablecoin runs

at the core of the network instead of sitting on top of it.

Arc is still EVM-compatible, so developers don’t need to rebuild from

scratch, as the chain is built for practical use, with sub-second

settlement, integrated FX, and privacy features that actually matter

when handling real payments or enterprise flows. Rather than stacking

features on later, the architecture builds wallets, payments, and

asset transfers into the foundation.

Circle isn’t alone either.

MetaMask and Stripe’s payments division, Tempo, are also launching

stablecoin-first chains, so we can definitely see that the direction

is clear, and this is where things are headed. Web3 infrastructure is

moving away from one-size-fits-all platforms and shifting toward

stacks built around stablecoins as the foundation.

Native, composable payment rails are becoming the baseline, and Uptick

is moving in this direction with stablecoins that sit inside the

infrastructure, and where payments become part of how the system

operates rather than an added layer.

Bridged USDT and USDC still have a role, but they aren’t built for

what comes next.

For applications like NFT marketplaces, modular data systems, portable

credentials, and creator-owned ecosystems, native stablecoins are

required, and without them, the limitations go deeper than

surface-level friction, because the structure itself starts to break.

Native stablecoins operate at the infrastructure level.

Marketplaces, dApps, wallets, and credential flows can use them

directly, without retooling or relying on external systems. They also

align with Uptick’s architecture, where everything is modular,

portable, and built to function inside the stack, rather than

alongside it.

This foundation supports payment flows that feel familiar to Web2

users, all while staying grounded in the principles of Web3. Loyalty

programs can extend across platforms, checkout can run natively on

mobile, and stable units can settle without constant translation or

extra logic.

As Uptick expands with new interfaces and integrated flows, the demand

for native, composable currency becomes structural, and without it,

core layers like governance and marketplace logic stay disconnected.

Stablecoins need to operate in real time, inside real systems, across

real applications.

Stablecoins have been an incredible innovation, but they only truly

start to deliver once they become composable, and most of Web3 hasn’t

reached that point. Uptick is building toward a future where they

function as fully composable infrastructure, integrating across

applications, connecting to real systems, and adapting to new use

cases.

That’s the difference between a bridged token and a stable foundation,

and it’s what makes Web3 usable at scale.

The next wave of stablecoin adoption will depend on technical

improvements, but even more on how payments, compliance, and

real-world asset support are built directly into the infrastructure.

These are the systems that move Web3 from the margins into real

economic activity.

The real test is whether stablecoins hold up under pressure, because

they need to function inside live applications, settle value across

networks, and stay aligned with changing standards across regions. To

get there, they have to operate at the infrastructure layer, wired

into the system from the start.

In the end, the networks that treat stablecoins as infrastructure are

the ones most likely to shape what Web3 builds on.