Web3 Infra Series | Building Real Infrastructure for RWAs

Published on Apr 28, 2025

Ownership used to be fairly straightforward, whether it was a deed in

a drawer, a signed contract, or a record that quietly said “this is

yours.” It worked, but only within the walls it was built for. It

couldn’t move, it couldn’t adapt, and it definitely couldn’t be

programmed.

This is now starting to change.

Real-world assets are evolving into digital form, and not just as

rudimentary scanned documents or tagged containers, but as

programmable assets connected directly to on-chain infrastructure,

able to operate across networks, respond to conditions, and interact

with other systems.

We have learnt that when value becomes programmable, ownership becomes

a function, and not simply a label. It opens up liquidity, expands

market access, and shifts the role of the asset itself.

Traditional systems have started to show their limits, and not because

they broke, but because they were never designed for this kind of

movement, this kind of intelligence, or this kind of scale.

These days, you can pretty much slap a token on anything. That part is

easy, the real challenge is getting that token to actually do

something.

Not all real-world assets are the same.

A carbon credit behaves differently from a painting, and a real estate

deed does not need the same logic as a royalty stream. These are not

static files, they each have a unique lifecycle. Some expire, some

generate income, some need validation, and many require conditions for

redemption, transfer, or attestation updates.

To function properly, they need infrastructure that understands all of

it.

This is where modular systems like Uptick Network come in. The

architecture is layered across base, protocol, and application, with

each part handling a specific role. Assets are not forced into a

single mold, each one gets its own logic, its own flow, and its own

lifecycle.

That means your real estate token isn’t interfering with someone’s

tokenized tracklist, and a music royalty payout is not delayed just

because carbon offsets are being minted. Compliance, usability, and

update logic all run on their own, without clogging each other’s

systems.

This setup is more efficient, but more importantly, it is necessary.

Without it, you end up with one-size-fits-none infrastructure, and if

Web2 taught us anything, it’s that forcing everything into the same

system only works for the gatekeepers, not for the users.

Web3 does’nt need another silo.

Web3 needs infrastructure that adapts to the assets being built on it.

When that happens, everything from auditing and integration to

regulation becomes easier, and the user experience improves. The most

forward-looking platforms are already building around this, and

tokenized finance is treated as a collaborative stack, with wallets,

registries, data feeds, and KYC modules all designed to be

interchangeable and verifiable.

These are not isolated tools, they are pieces of market infrastructure

built to evolve with what the space demands.

RWA tokenization depends on reliable infrastructure, both in the

technical foundation and the economic environment around it. It’s not

about how the platform token performs in the market, it’s about

whether asset issuers feel confident putting real value on the chain.

If the base layer is unstable, if validator incentives are skewed, or

if the token model favors speculation over actual usage, that

confidence evaporates, because this is not a space where asset issuers

can afford to take chances.

Real-world value brings real-world consequences.

If a network upgrade breaks compatibility, or token volatility throws

off transaction costs, hesitation sets in, issuers step back,

regulators become cautious, and adoption stalls before it ever gets

going. Economic instability is often the quiet reason deals collapse.

Sudden inflation of the native token, governance weighted by validator

concentration, or reward systems that dry up after a few months are

all massive red flags.

Issuers do not want shifting incentives, they want consistency.

This is why the people behind the infrastructure matter, their

philosophy matters, and their roadmap matters, especially if it

reflects actual delivery. What also matters is whether they understand

the needs of asset issuers, not just crypto-native experiments. You

can’t drop RWAs into any system and expect it to hold. The base needs

to be stable, mature, and built for sustained activity.

These NFTs can eventually become identity markers, evolving

credentials, or interoperable passes that retain meaning across

environments, operating as living components within composable

systems, and designed to travel, adapt, and function across the

broader Web3 stack.

A recent case, no need to name it, already showed what happens when

infrastructure is designed for hype instead of durability. Once trust

disappears, it is not easy to bring back.

The entire stack depends on the base being solid.

If that cracks, no token standard or oracle setup is going to hold the

rest together. Uptick is built with this in mind, providing a

foundation for real-world issuance that can scale with confidence. The

architecture supports long-term lifecycle management, stable

protocol-level logic, and compliance-ready modules, giving issuers the

certainty that what they build today will still work tomorrow.

Programmable assets only work if they stay connected to the real

world.

This is where RWA oracles come in, bridging off-chain events with

on-chain logic. Interest payments, rent adjustments, credit triggers,

energy usage, all of these rely on verified data streams that update

the asset’s state in real time.

Uptick is planning integrations with oracle frameworks built for

domain-specific sync, aiming to support assets like energy credits

that respond to live meter data, or IP royalties that adjust based on

actual streaming counts. Carbon credits may lock or unlock based on

emissions registry inputs, and these are real-world hooks that, once

connected, trigger programmable outcomes.

New trust models are starting to support this shift, and verified data

agents, cross-network attestations, and standards for machine-readable

compliance are no longer edge cases, they are becoming core components

of tokenized systems. The goal is not simply delivering data, it’s

providing provable context, so that asset behavior reflects what is

actually happening in the real world.

Without reliable oracles, tokenization loses the very thing that gives

it value.

You cannot have programmable assets without real-time input, and this

is what makes oracles more than a backend feature, they are the

foundation that powers programmable value.

For the most part, and depending on the specific use case, a token

that cannot move is not worth much. If a tokenized asset is locked to

one chain, its utility is immediately limited. It might represent

value, but it is stuck in a walled garden with no way out.

True utility means portability.

This means being able to go where the demand is, where the

applications are, and where the capital flows. Uptick currently

supports cross-chain NFT movement via its Uptick Cross-chain Bridge

and Inter Blockchain Communication protocols, and is developing

extensions to enable similar portability for tokenized real-world

assets. The aim is to preserve metadata, ownership history, and

embedded logic as tokens travel between networks, giving assets the

mobility they need to function across fragmented environments.

The space is already moving past speculative tokens. These are real

assets, moving through real systems, solving real-world problems.

Cross-chain connectivity is the part that unlocks actual

functionality, tying together public, private, and institutional

networks.

It also helps break the interoperability deadlock.

Instead of waiting for every system to follow the same standards,

cross-chain mobility allows tokens to move freely between them. Most

institutional systems are still isolated, but interoperability is what

turns pilot programs into actual real-world infrastructure.

Regulation is finally starting to catch up.

The UAE already has frameworks in place for RWAs, and both Singapore

and the EU are also moving pretty fast. This is a good thing, because

regulation doesn’t kill innovation, it gives it structure, and

structure is what makes scale possible.

Compliance, however, is complicated in a permissionless world. When

anyone can use the network, how do you follow the rules? The answer is

not to restrict the network, it is to embed the rules into the asset

itself.

Uptick handles this at the protocol level, where each asset can carry

its own rule set. Some assets might remain permissionless, others

might include identity checks, region restrictions, or time-based

conditions. Digital identity modules like Uptick DID can plug in

directly, and zero-knowledge proofs can handle the rest, enabling

compliance without requiring surveillance.

Compliance needs to be granular, not blanket.

It should be programmable at the asset level, not enforced through

centralized control. That is how RWAs scale without sacrificing the

core principles of decentralization.

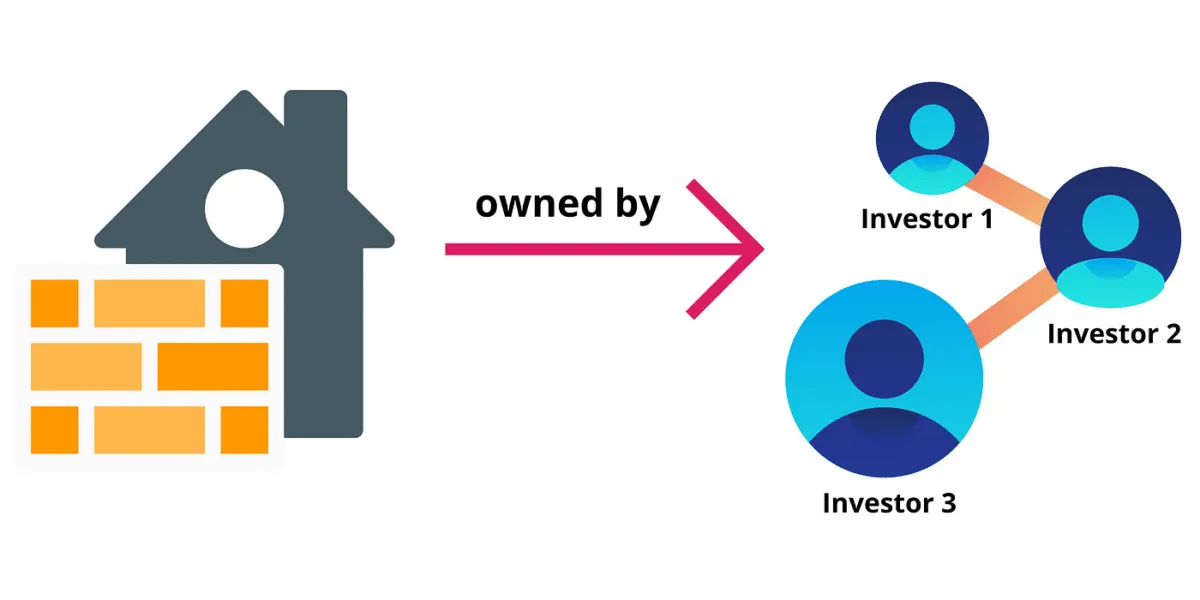

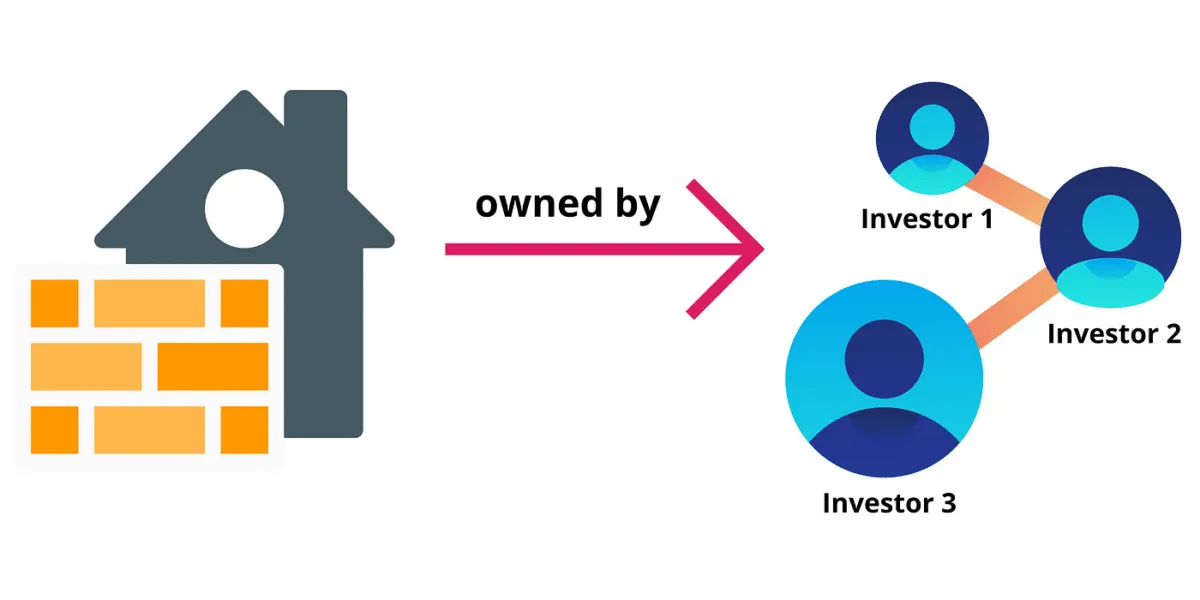

When we talk about assets like beachfront property, rare art, or

high-end collectibles, for most people, these are completely out of

reach. You’re not buying those unless you are sitting on some serious

capital. Tokenization changes that by breaking assets into smaller,

tradable units.

You no longer need to own the whole thing, you can own a piece of it.

Yes, this is about access, but it is also about participation. You can

co-own part of a short film, support an indie game, back a physical

product line, and actually benefit if it takes off. These are still

transactions, but they should also be seen more as relationships.

Even time is being tokenized, as creators offer slices of their

availability as tradable assets. Earnings potential is becoming

collateral, and these changes are already happening in practice.

Fractionalization builds communities around value, giving fans and

early adopters a way to benefit alongside creators. This aligns

incentives and turns holders into supporters, not just speculators.

This is how long tail assets become viable.

The kinds of things that may not fit traditional portfolios but

absolutely thrive when owned collectively, like cultural assets,

social goods, local infrastructure, or creative IP. Liquidity also

improves, as smaller units trade more frequently, with tighter spreads

and broader reach, opening up access without reducing quality.

Not every asset should be public.

Some real-world assets involve sensitive, personal, or proprietary

data. Think about patents, medical records, enterprise contracts, or

credit profiles. These require privacy guarantees that are built

directly into the infrastructure. Uptick integrates zero-knowledge

proofs, encrypted metadata, and selective disclosure modules, allowing

assets to prove compliance, authenticity, or ownership without

exposing the underlying information.

Data can be shared only with authorized parties, under specific

conditions, without broadcasting it to the entire network.

This is also not about hiding information for the wrong reasons, it is

about giving users control. It’s about allowing institutions to

operate within regulatory frameworks, while individuals retain

ownership over their data.

Privacy becomes the enabler, not the obstacle.

As tokenization moves into sectors like healthcare, legal services,

research and development, and identity systems, privacy isn’t merely a

feature, it becomes the gatekeeper, and without it, entire markets

remain off-chain. Privacy-preserving compliance will define the next

phase of RWA growth, and protocols without native support for it will

more than likely not end up being able to scale.

So, this is not something you bolt on, it’s a fundamental requirement

for any Web3 ecosystem that expects to handle serious value.

You’ve tokenized an asset, but now what?

If it cannot move, trade, or connect to financial infrastructure, it

just sits there. Tokenization only works when there is liquidity

behind it. Uptick is focused on linking tokenized assets to real DeFi

use cases such as lending, collateral, marketplaces, and auctions.

Once connected, assets become usable, tradable, and composable. A

tokenized bond could back a loan, a fractional IP portfolio could be

bundled and sold, and a rare collectible could enter a 24-hour market

without the need for centralized brokers.

Liquidity turns digital ownership into economic power.

It enables price discovery, capital formation, and optionality. It

also reduces risk by offering real exit paths and ongoing valuation.

The cold start problem is real, because liquidity draws usage, and

usage builds liquidity.

Infrastructure has to handle both sides at once for tokenization to

work at scale. Uptick’s approach aims to include programmable lockups,

automated revenue flows, and cross-chain asset movement, giving

builders the tools to design new markets without legacy

intermediaries.

Tokenized repo platforms today handle billions of dollars in daily

transaction volume, with cumulative settlements across major platforms

already exceeding $1 trillion USD. That is just one example of

liquidity infrastructure working properly.

Shorter settlement windows, intraday liquidity, and automated

servicing are producing real results, and the same structure is now

expanding into other asset classes. In the end, liquidity is what

gives tokenization its value.

Without it, you’re left with static digital placeholders, but with it,

you unlock movement, confidence, and real financial utility.

It’s safe to say that the RWA narrative is no longer just a theory or

a buzz-word. We are well past that point. Institutions are investing,

regulations are taking shape, and the infrastructure is maturing.

Adoption will not happen evenly, because some asset types will scale

faster than others.

Money market funds, tokenized bonds, and onchain lending are already

showing real traction. Others, like real estate or equities, may

follow as infrastructure improves and minimum viable ecosystems form

around them. Current forecasts estimate tokenized financial assets

will reach around two trillion dollars by 2030, with upside scenarios

going as high as four trillion.

Either way, this is happening at scale.

Uptick’s role is to build the connective tissue, using modular,

interoperable, composable infrastructure that links directly to the

real economy.

That means supporting legacy systems, meeting compliance requirements,

and delivering production-grade infrastructure that moves with global

finance, not just isolated Web3 use cases. With RWAs, we are not

reinventing ownership, we are actually rebuilding how it functions

from the ground up.